Jan 3, 2023

Crypto starts year with low trading volume after 2022 downturn

, Bloomberg News

Crypto should go through sorting out and could be a lot healthier commodity at the end: Greg Taylor

Cryptocurrencies are starting the year with a whimper as trading volumes remain desiccated in the wake of 2022's numerous industry scandals and meltdowns.

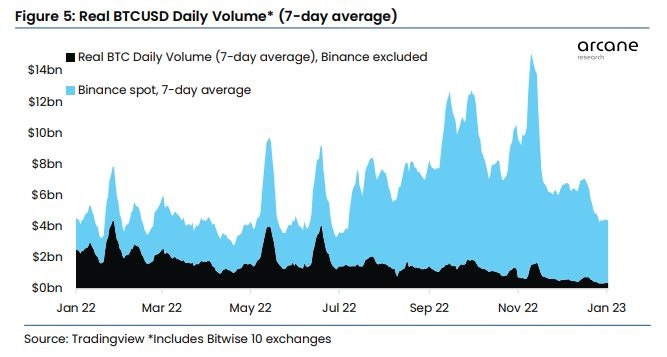

Trading volumes on Binance, the biggest digital-assets exchange, are at lows not seen since last summer, while those outside of the platform are also shallow, according to Bendik Schei and Vetle Lunde at Arcane Research.

Some of the slump can be blamed on the holidays and the closure of US markets during that period. But the declines have also been exaggerated by “a general exodus” of active retail participation, as well as the fear of other potential negative catalysts that could still rattle the industry, the analysts wrote in a report.

Bitcoin volatility has declined sharply, with a seven-day reading falling to 0.7 per cent and hovering at lows not seen since 2020.

Cryptocurrencies had an awful 2022 as a number of the industry's key projects combusted, wiping out billions. Bitcoin fell 64 per cent last year, notching its second-worst annual performance on record, while plenty of other tokens fared even worse. The scandals and price decline have driven away many institutional and retail investors. JPMorgan Asset Management said recently that “crypto is effectively nonexistent for most large institutional investors.”

Bitcoin on Tuesday hovered around US$16,600, down from roughly US$46,000 at this point last year. Ether traded around US$1,200, off by nearly 70 per cent from the same time in 2022. Elsewhere, Solana, the digital token backed by fallen crypto mogul Sam Bankman-Fried, is down 95 per cent since its November 2021 peak, though it managed to rally 16 per cent on Tuesday.

“The near-death experience that was 2022 for so many players will cast a long shadow deep into 2023,” B2C2's Adam Farthing wrote in a note. “Low valuations and damaged balance sheets will mean the continued prioritization of credit risk over market opportunity. And as a result, the market will demand a safer alternative to the current stock of unregulated offshore exchanges performing dual functions of custody and matching.”