May 11, 2024

Crypto VCs Turn Back to ‘Professor Coins’ as Funding Rebounds

, Bloomberg News

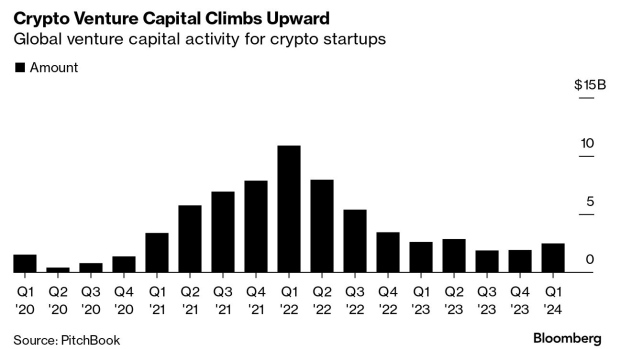

(Bloomberg) -- Venture capitalists are turning back to crypto startups founded by professors as funding for the digital asset industry takes off again.

Companies like Sahara, CheckSig and NEBRA were all launched by academics and raised fresh capital in the past two months, but two startups have stood out in a category that the industry has nicknamed “professor coins.” EigenLayer, founded by Sreeram Kannan, a former associate professor at the University of Washington, raised $100 million from Andreessen Horowitz in February, while Babylon, started by Stanford University Professor David Tse, secured $18 million in December. Both projects are focused on a growing area of crypto called “restaking,” which allows new projects and blockchains to get a head start by borrowing Ethereum or Bitcoin’s security infrastructure and resources.

Some of the technology that people are turning to to produce yield in this crypto cycle is “coming out of research from David and Sreeram,” said Riad Wahby, an engineering professor at Carnegie Mellon University and chief executive of crypto startup Cubist. “They’ve thought about a lot of these kinds of restaking technologies. I mean, that’s sort of their baby, so it kind of makes sense. And I think more and more of this technology is going to come from research.”

Kannan spent two years as a postdoctoral scholar at University of California, Berkeley and Stanford, and worked with Tse, according to his biography on the web page for the University of Washington’s Information Theory Lab. The duo collaborated on 23 academic papers between 2015 and 2023, writing extensively about blockchain and the concepts that underpin their respective startups, according to computer science bibliography website DBLP. Both Kannan and Tse did not respond to requests for comment.

Kate Laurence, CEO of Bloccelerate VC, said her venture firm often sees an academic background as a detractor when it comes to deciding which founders to back. “Professors tend to be focused on academics and the theory, not as much on the practice and business application,” she said.

But Kannan’s work on restaking and his close relationship with Tse led Bloccelerate to invest first in EigenLayer and then in Babylon as well. “They work together and they are solving the same problem, but EigenLayer’s solving in a different market,” she said.

The process of “restaking” is a takeoff on the method that runs Ethereum, where tokens are deposited or “staked” to the network to help validate transactions on the blockchain. For new projects and blockchains running on the same mechanism, building their own staking support can be too slow and costly given a lack of activity and capital. Restaking allows the newcomers to borrow Ethereum’s staking power to get a head start.

Babylon adopts a similar approach but focuses on Bitcoin. This task is more complex since Bitcoin uses a different mechanism, proof of work, to validate transactions. If successful, Babylon’s platform will also address a long-standing issue for Bitcoin holders: the lack of yield generation.

Vance Spencer, whose firm Framework Ventures also invested in Babylon, said it makes sense that this kind of advanced technical work is coming out of universities. “There are so few people who can build a blockchain,” he said. “They’re just very likely to come from these research institutions.”

Not Without Controversy

But the road ahead isn’t often easy for professor-led crypto projects, with most of them failing, according to Emin Gun Sirer, a former associate professor of computer science at Cornell University and CEO of Ava Labs, which developed the Avalanche blockchain.

“They play a game of technical novelty,” Sirer said. “And not one of product-market fit.”

Despite attracting more than $15 billion in crypto assets to its platform, according to DefiLlama, EigenLayer hit its own setbacks with what critics pegged as a misunderstanding of the broader digital asset market.

Despite Kannan telling Bloomberg in February that there were no plans for a token, EigenLayer released a launch plan for its Eigen currency in April and began distributing it on Friday. The plan drew a backlash after it was revealed that Eigen would have a total supply of about 1.67 billion tokens, with more than half designated for investors and early contributors. This allocation raised criticisms of self-enrichment among EigenLayer’s team and initial backers, as well as fears among users about potential sell-off pressure. The decision to make the tokens non-transferable at launch also frustrated some early users who invested large amounts of capital on EigenLayer.

The Eigen Foundation, which is responsible for the token, said in a blog post that by making the coins non-transferable, it can have more time to improve decentralization of the project, as well as enhancing key features associated with the token.

Ayesha Kiani, chief operating officer of crypto hedge fund MNNC Group and an adjunct professor at New York University, disputed the criticism of EigenLayer, arguing that the startup isn’t just another get-rich-quick scheme. She said Kannan and Tse are leading efforts to improve the industry more broadly.

“The industry basically criticizes them for a lack of decentralization, or just another money-making grab, or you know for whatever reason,” she said. “We as an industry are so used to having free incentives at this point that if nothing goes our way, we have to basically trash on the project.”

©2024 Bloomberg L.P.