Aug 23, 2022

DBS Exchange Says Bitcoin Trading Surged Amid Global Selloff

, Bloomberg News

(Bloomberg) -- DBS Group Holdings Ltd. said the number of trades on its digital exchange more than doubled in June from two months earlier with buys accounting for 90%, in contrast to a massive sell-off in crypto assets globally.

The quantity of the world’s largest token, Bitcoin, bought on the members-only exchange was four times higher than April, according to a statement from Southeast Asia’s largest lender, which did not provide numbers for other months. DBS launched the digital exchange in December 2020.

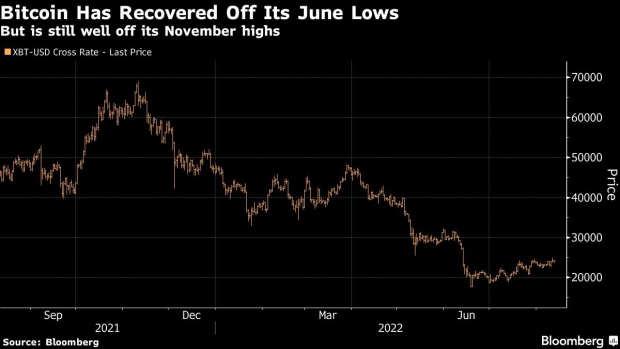

Cryptocurrency prices have fallen sharply since May, when the collapse of stablecoin project Terra set off a wave of liquidations, bankruptcies and layoffs in the sector.

“Investors today are instead seeking out safe harbours to trade and store their digital assets amid the ongoing market volatility,” Lionel Lim, chief executive officer at DBS Digital Exchange, said in the statement.

While the bank has seen strong traction in its digital exchange which serves institutional investors and family offices, it has pushed back its plans to offer crypto trading for retail investors, citing technological challenges and resistance from regulators.

Singapore is walking a fine line between building a blockchain hub in which innovations can flourish, and also protecting retail investors from crypto markets’ volatility.

©2022 Bloomberg L.P.