May 17, 2023

Debt-Cap Angst Sends Traders to Swiss Franc for Proven Hedge

, Bloomberg News

(Bloomberg) -- As political stalemate threatens to drag the world’s biggest economy into default, investors are revisiting a time-tested way to hedge US risk — the Swiss franc.

The currency, often seen as a haven alternative to the dollar, has a history of outperforming when American legislators squabble over raising the federal debt limit. That’s why, in this latest showdown, traders are using the franc — and other non-US currencies, even Brazil’s real — to protect against wild swings and potential losses tied to their dollar exposures.

“It is the debt ceiling that is the principal concern for markets at this point,” said Meera Chandan, co-head of foreign exchange strategy at JPMorgan Chase & Co. in London. “Hedges are prudent in the FX space.”

Anxiety is already rising. Treasury Secretary Janet Yellen warned on Monday the US risks running out of sufficient cash for all federal obligations as soon as June 1. Distortions have emerged in the Treasury-bill market that pinpoint particularly intense risk between early June and August.

Hedging demand for that same period has also picked up, briefly pushing the gap between one- and three-month tenors on JPMorgan’s Group-of-10 currency volatility gauge to the widest since September 2020. Protections against a breakout in the widely used Cboe Volatility Index, known as Wall Street’s fear gauge in stocks, have also seen the most demand in five years.

Read more: Yellen Warns ‘Time Is Running Out’ Ahead of Biden-McCarthy Meet

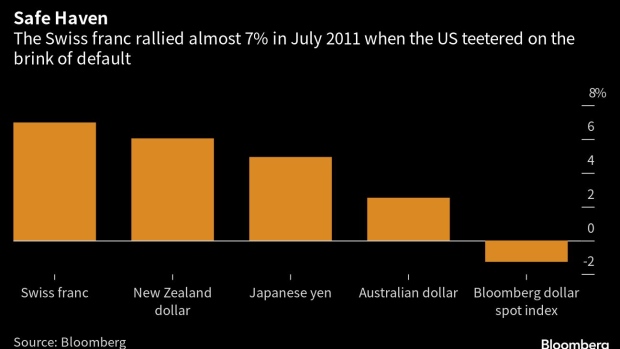

But for investors thinking back to 2011, when the government edged close to default, the Swiss franc is king. In the month leading up to the late-July deal that averted that crisis, the Swiss franc rallied almost 7% versus the greenback to be the best performer among 31 major currencies tracked by Bloomberg. The currency was trading little changed at 0.8966 per dollar as of 8 a.m. in London on Wednesday.

The momentum is likely to return as the risk of US default mounts, according to JPMorgan, as the “franc has taken its cue from the debt ceiling theme.”

The US bank in late April entered into a dollar-franc forward-volatility agreement for the period between June 1 and Aug. 10 and has maintained its recommendation ever since. One-month implied volatility on the franc briefly spiked above 24% in August 2011, more than triple the current reading of about 7.5%.

Favored Franc

Citigroup Inc. analysts led by Benjamin Randol also touted the franc as a way to protect against increased debt-ceiling risks. They recommended last month that investors go long the franc through put options expiring in late June, with a risk-aversion hedge that captures the franc’s haven qualities and outperformance in past US debt dramas.

The Swiss currency, however, is in a different position than it was the last time a US default seemed imminent more than a decade ago.

Chang Wei Liang, a Singapore-based FX and credit strategist at DBS Group Holdings, pointed out that the franc’s costly valuation may pose risks to bullish trades. The franc is among the most overvalued in the world based on effective exchange rate metrics and has grown even more so in recent months, according to the strategist.

The risk, he wrote in a note earlier this month, is that an even-stronger franc may be “counterproductive given the sharp decline in inflation now.”

Other currencies have also entered the conversation. Mark McCormick, Toronto Dominion Bank’s global head of FX strategy, said the Japanese yen, Chinese yuan and even the Brazilian real are among the best hedges against US debt-ceiling risks.

The yuan and real, he wrote in a May 9 note, “offer the right beta” to equity markets, suggesting that any US-driven risk event might not benefit the dollar much. The Brazilian currency also offers a nice carry cushion, while the yen remains an all-weather hedge against dollar weakness, according to McCormick.

Eyes on the Dollar

For now, dumping the world’s most-popular reserve currency is far from a consensus view. But some are starting to focus more on dollar weakness than on strength in the franc or other currencies.

The Bloomberg Dollar Spot Index is down about 1.4% so far this year, with Bank of America Corp.’s Adarsh Sinha saying the greenback is “effectively a high-yielder, meaning lower rates and high volatility can both be more negative for the currency than they were in 2011.”

Should the US stop paying its obligations, the dollar stands to weaken by an average of 2.6% relative to the yen and franc, according to 78% of the 123 institutional investors surveyed by JPMorgan between May 9 to 11.

“Those with longer-term books — asset managers and corporates — will be very cautious with long US dollar exposure,” said Alan Ruskin, chief international strategist at Deutsche Bank AG.

--With assistance from Anya Andrianova.

(Updates with latest franc pricing in sixth paragraph.)

©2023 Bloomberg L.P.