Nov 17, 2023

Debt Sustainability Is ‘North Star’ for Italy, Top Official Says

, Bloomberg News

(Bloomberg) -- Italy will never put the sustainability of its mammoth public debt at risk, a senior official in Giorgia Meloni’s government pledged just ahead of a closely-watched rating decision on the country.

“Italy’s sovereign debt remains sustainable because the government’s policies are all aimed at sustainability of debt, it is our North Star,” Federico Freni, undersecretary at the finance ministry, said in an interview in Milan on Friday. “To question sustainability of debt would be hugely damaging and we would not do that.”

Italy’s economy is slowing and almost entered a recession in the third quarter of this year. That will make it harder for Premier Meloni’s right-wing coalition to keep public finances in check, particularly deficit and debt as a percentage of output.

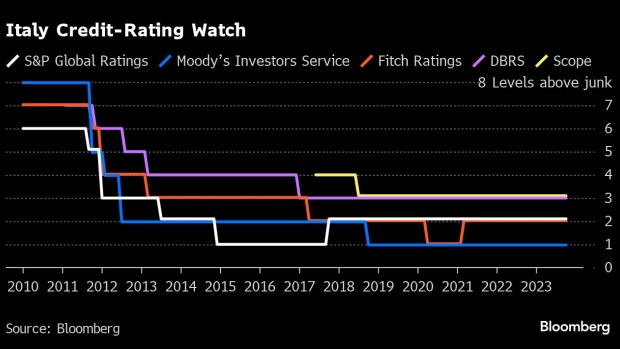

The difficult situation has put Italy in the sights of Brussels officials, ratings companies and investors after the government unveiled a loosened public finance profile for the coming years. Moody’s Investors Service has penciled in Friday as a potential moment when it could downgrade the country to junk.

Freni, of the League party, said the government always keeps investors in mind and is aware that growth is the only way out of its debt problems.

“We want to reduce debt by stimulating growth but we are against any kind of austerity policy to do so,” Freni said. He added that he is confident Italy will manage to spend the over €190 billion ($207 billion) in recovery fund cash that is coming its way in the next few years.

The European Commission, the European Union’s executive, said earlier this week that Italy’s debt ratio will rise in the next two years and its deficits will be wider than the government predicted in its budget.

The commission sees the deficit narrowing to 4.3% in 2025 instead of the 3.6% projected by Rome. Debt as a percentage of gross domestic product is seen increasing to 140.9% in 2025. By contrast, the government envisages the ratio falling below 140% on that horizon.

The difference in projections is due to higher debt-servicing costs than those Meloni’s government is factoring into the budget, the likely renewal of a tax break that the administration didn’t include, and a bigger increase for public-sector salaries.

Italy may also face tensions with the EU as it struggles to keep its public finances in check. The prospect of a deficit still noticeably above 3% two years from now could prove a point of contention with the bloc, given that its Stability and Growth Pact limiting shortfalls to that ceiling will kick in again as of January.

Euro-region finance ministers are currently at loggerheads on how the reinstated fiscal framework should be applied, a stand-off that is alarming European Central Bank officials.

“I expect that the stability pact will bring about a new Europe that takes into account sustainability of accounts for each state and takes into account that each state invests differently and needs a different level of investment,” Freni said.

“We need different models for considering investments. I expect in particular that there won’t be a separation between ‘good students’ and ‘bad’ ones, otherwise we will end up damaging Europe,” Freni said.

--With assistance from Tommaso Ebhardt.

©2023 Bloomberg L.P.