Feb 24, 2023

Diesel Pours Into Europe as Barrels From East Fill Russian Gap

, Bloomberg News

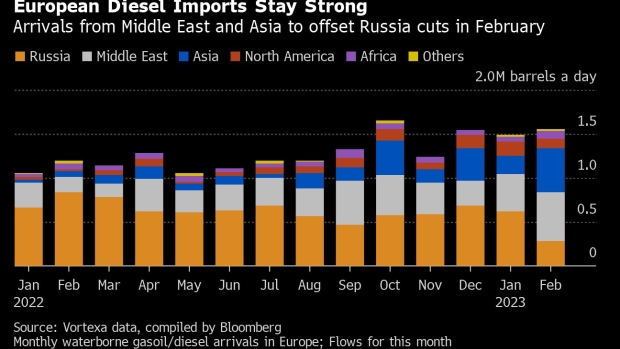

(Bloomberg) -- Europe has been able to import large amounts of diesel in February even after the start of sanctions on purchases from Russia, its top external supplier until earlier this month.

Arrivals of diesel-type fuel are set to slightly beat January’s level, early estimates from Vortexa Ltd. show. That’s mostly due to the Russian gap being filled by shipments from the Middle East and Asia.

In fact, if all of the current observed cargoes for February arrive before month-end, flows from those two regions are likely to hit the highest since at least 2016.

Europe’s imports of diesel or gasoil-type fuel are poised to be about 1.55 million barrels a day this month, marginally above January’s amount, according to initial Vortexa data compiled by Bloomberg.

“The absence of Russian barrels has likely opened up an opportunity for East of Suez suppliers,” Vortexa analyst Pamela Munger said. Some 60% of diesel imports from the Middle East and Asia for Feb. 1-18 came into the Amsterdam-Rotterdam-Antwerp region, she said.

Russian fuel arrivals for this month are set to be the lowest in at least seven years. Those shipments that reached Europe in the few days before the new sanctions kicked in on Feb. 5 will equal about 282,000 barrels a day, far below the average of 683,000 barrels a day in 2021, before Russia’s invasion of Ukraine.

Diesel margins in Europe — the profit from refining the fuel from crude — have steadily declined this month amid resilient fuel supply in the continent and lower demand due to mild winter.

Europe stepped up its diesel imports since late last year, ahead of the introduction of sanctions. Gasoil stockpiles in the ARA storage hub are at a two-year high, according to Insights Global data.

Large amounts of diesel entering Europe reflect ample supplies and may further pressure European diesel cracks, Munger said.

©2023 Bloomberg L.P.