Nov 8, 2023

Disney tops profit estimates, seeks extra US$2 billion in cost savings

, Bloomberg News

Reasons to buy Disney as it trades near 9-year lows

Walt Disney Co., embroiled in another fight with activist investor Nelson Peltz, posted better-than-expected fourth-quarter earnings and said it will seek an additional US$2 billion in cost savings.

Earnings at the world’s largest entertainment company rose to 82 cents a share, excluding some items, Disney said Wednesday. That beat the 69-cent average of analysts’ estimates compiled by Bloomberg. Revenue grew 5.4 per cent to $21.2 billion, compared with estimates of $21.4 billion.

The profit increase and expanded cost cutting will help Chief Executive Officer Bob Iger counter Peltz, whose Trian Fund Management controls a roughly $2.5 billion stake in Disney and plans to seek several board seats. Iger had previously committed to cutting more than $5.5 billion from annual expenses and has already eliminated 7,000 jobs.

Disney’s flagship theme parks delivered the biggest profit boost, with earnings rising 31 per cent to $1.76 billion in the period ended Sept. 30. Revenue in the division, which includes consumer products, grew 12 per cent to $8.16 billion, led by 55 per cent growth internationally.

Losses in Disney’s streaming business, including ESPN+, narrowed to $387 million in the quarter, coming in better than Wall Street projected. The company has said it’s seeking to turn a profit in that business by the fourth quarter of the new fiscal year just getting underway.

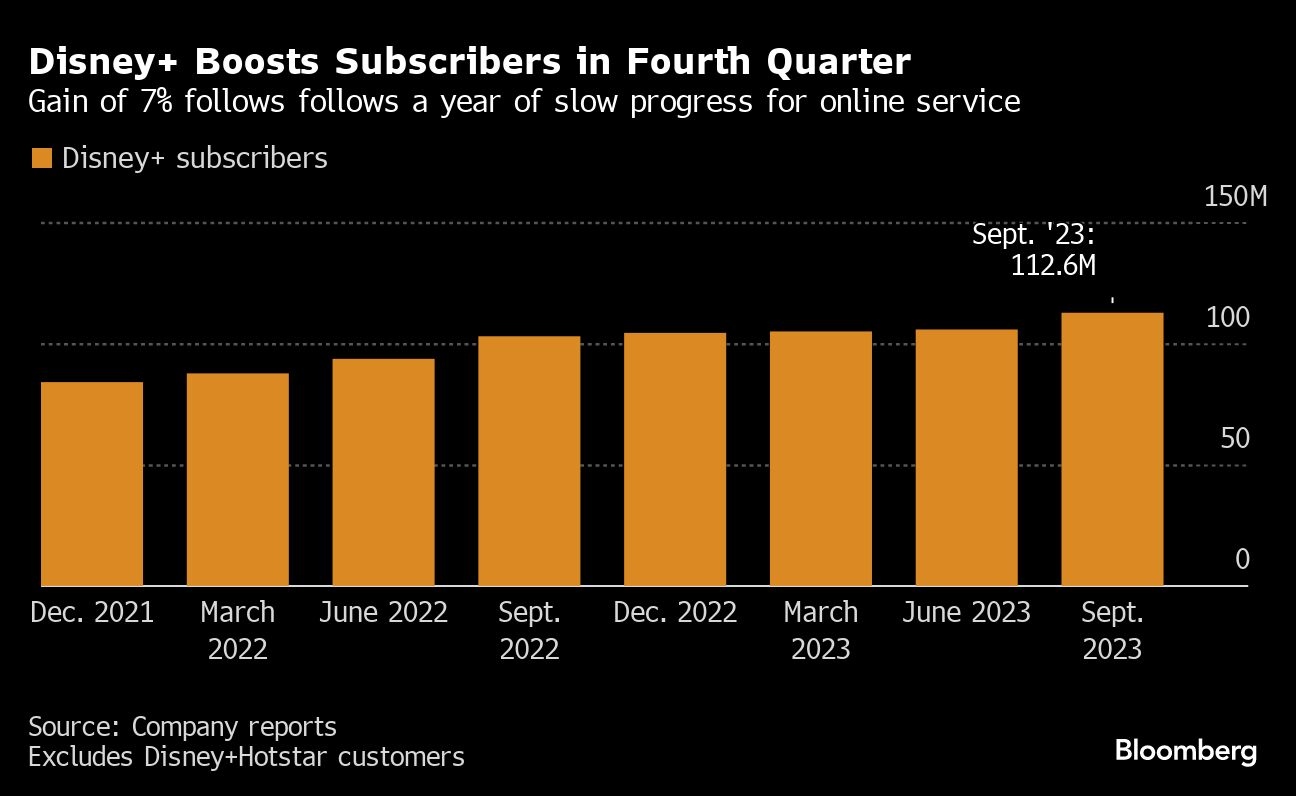

Globally the number of Disney+ paying subscribers rose to more than 150.2 million, beating estimates of 147.4 million and returning sign-ups to growth. So-called core Disney+ subscribers grew 7 per cent to 112.6 million.

Shares of Disney rose about 2 per cent in extended trading after the announcement. The stock had been down roughly 8 per cent since Iger returned as CEO last November after the ouster of his successor, Bob Chapek.

From the start of Iger’s second term, Peltz has argued that Disney’s costs are too high, that its board should be held more accountable in areas such as succession planning, and that the company should restore dividend payments, which haven’t been paid since the pandemic.

Disney previously said it intends to pay a modest dividend to shareholders this year. Peltz’s holdings include shares pledged by Ike Perlmutter, the former chairman of Marvel Entertainment who was fired by Iger earlier this year after lobbying for Peltz to join Disney’s board.

Peltz dropped an initial push for board representation after Iger unveiled his first round of cost cuts.

REPOSITIONING DISNEY

In addition to reducing expenses, Iger is evaluating how to reposition Disney as its company’s traditional TV networks, including ABC, National Geographic and FX, continue to lose viewers and advertisers.

Earlier Wednesday, shares of Warner Bros. Discovery Inc. shares fell by the most in more than a year after the company reported a drop in network advertising and said the market may remain challenged next year.

Disney’s CEO has suggested he’s open to selling those operations, as well as possibly seeking a minority investor or joint venture with a tech company to accelerate the ESPN sports network’s transition to streaming.

Earnings from the company’s entertainment networks were little changed at $805 million, while revenue slumped 9.1 per cent to $2.63 billion. Like other broadcasters, Disney is suffering from falling ad sales and lower subscriber revenue at traditional TV networks.

Disney is also buying rival Comcast Corp.’s one-third stake in the Hulu streaming service for at least $8.61 billion.

Management broke out the results of ESPN separately for the first time this quarter, saying revenue at its sports networks was little changed at $3.91 billion, while earnings grew 14 per cent to $981 million. Disney credited higher subscription revenue and lower programming costs.

This week, the company announced that PepsiCo Inc.’s chief financial officer, Hugh Johnston, would become its new CFO.

A veteran finance and operations executive, Johnston helped lead Pepsi through a Peltz campaign in the 2010s.