Dec 15, 2022

ECB Delivers Smaller Hike While Confirming Bond Retreat in March

, Bloomberg News

(Bloomberg) -- The European Central Bank increased interest rates by a half-point, with President Christine Lagarde telling investors to prepare for a long-running campaign of similar moves to quell the worst inflation in the history of the euro.

After successive hikes of 75 basis points, the ECB lifted the deposit rate more slowly on Thursday, to 2%, as economists expected. Pledging to push borrowing costs “significantly” higher, officials widened efforts to tame prices with a decision to shrink their €5 trillion ($5.3 trillion) bond portfolio.

“Anybody who thinks that this is a pivot for the ECB is wrong,” Lagarde told a news conference. “We should expect to raise interest rates at a 50 basis-point pace for a period of time.”

“We have more ground to cover, we have longer to go and we are in for a long game,” she said.

Traders added to rate-hike bets, pricing a deposit-rate peak of 3% next year, compared with 2.93% earlier. The Stoxx Europe 600 Index dropped as much as 2.9%, sinking to the lowest level in a month and by the most in nearly two months as rates-sensitive sectors like technology and retailers slumped.

Lagarde said financial markets hadn’t adequately accounted for the amount borrowing costs would need to rise to quell inflation.

Complementing the rate push, officials outlined plans for quantitative tightening — offloading government debt purchased as stimulus in the past. The plan envisages partially halting reinvestments of maturing bonds under the Asset Purchase Program from March. Volumes will average €15 billion a month in the second quarter, with the pace beyond that yet to be determined.

The ECB’s downshift on rate hiking, along with similar action this week by the Federal Reserve and the Bank of England, may reflect belief that the worst inflation in a generation — while not vanquished — is at least near its peak.

The announcement follows a first dip in 1 1/2 years for runaway euro-zone price gains and comes with the currency bloc probably already in recession.

But, like the Fed, the message was that monetary tightening has some way to run yet — despite policymakers in Frankfurt already overseeing the ECB’s most forceful-ever spell of rate hikes.

“If you were to compare with the Fed, we have more ground to cover, we have longer to go,” Lagarde said.

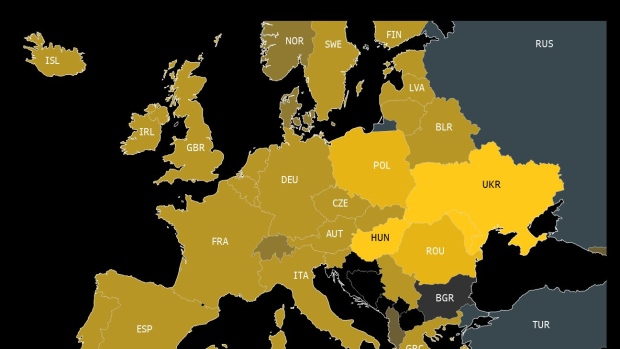

Fresh projections, also released Thursday, will help determine how long. With Russia’s war in Ukraine still raging, the predictions confirmed a challenging backdrop that includes economic expansion of just 0.5% in 2023. Forecasts for inflation, meanwhile, were raised for the next two years. It’s still seen above the 2% target in 2025.

A 2% deposit rate is in the vicinity of the theoretical neutral level that neither constrains nor stimulates the economy. But several officials have advocated further moves into restrictive territory as lofty energy prices continue to stoke inflation.

How high borrowing costs will ultimately be pushed is a central question now for investors, though it’s a topic on which policymakers are tight-lipped. Economists polled by Bloomberg before the decision foresaw only one more increase, in February, to 2.5%.

What Bloomberg Economics Says...

“Today’s meeting does not change our call for another large hike in February and a step down in March, but it does create significant upside risks. We will be focused on when and how fast underlying inflation measures drop to calibrate that view.”

—David Powell and Maeva Cousin. Click here for full REACT

The planned reduction in bond holdings adds a new element to rate bargaining among the Governing Council’s soon-to-be-26 members and may have helped garner support for a smaller hike from the panel’s more hawkish officials.

Several had pushed for an early start to QT, while their more dovish colleagues have fretted over the deteriorating economic picture and voiced a preference for less aggressive action on rates.

--With assistance from William Horobin, Alessandra Migliaccio, Veronica Ek, Ksenia Galouchko, Joel Rinneby, Harumi Ichikura, James Hirai, Carolynn Look, Alexey Anishchuk, Andrew Langley, Zoe Schneeweiss, Christoph Rauwald, Laura Malsch, Alice Gledhill, Cagan Koc, Ben Sills, Bryce Baschuk and James Regan.

(Updates with comment from Bloomberg Economics.)

©2022 Bloomberg L.P.