Dec 15, 2022

ECB to Slow Hike Pace as It Preps Market for QT: Decision Guide

, Bloomberg News

(Bloomberg) -- The European Central Bank is poised to slow the recent pace of interest-rate increases and outline plans to shrink its almost €5 trillion ($5.3 trillion) stash of bonds, broadening efforts to curb inflation that’s still five times the target.

After back-to-back hikes of 75 basis points, all but three of 51 economists surveyed by Bloomberg predict a half-point move on Thursday. That would take the deposit rate to 2% — around the point widely considered to neither stimulate nor constrain the struggling euro-zone economy.

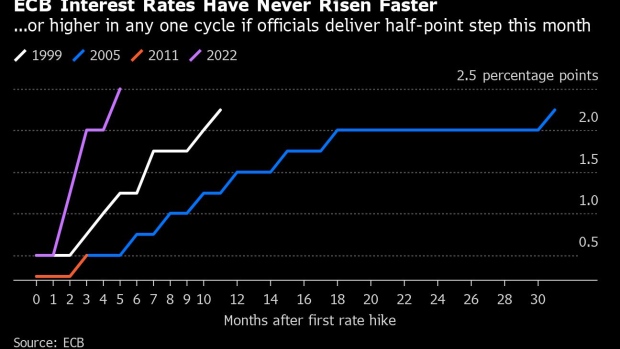

The more moderate increase may signal the peak for rates is coming into view following the most aggressive bout of monetary tightening in the ECB’s history. Price gains eased last month for the first time in 1 1/2 years, though remained in double digits.

While inflation has yet to be vanquished, other central banks are also starting to raise borrowing costs a little less fiercely. The Federal Reserve on Wednesday opted for a 50 basis-point increase after four hikes of 75. The Bank of England is expected to ease off in a similar fashion on Thursday.

The ECB will make its announcement at 2:15 p.m. in Frankfurt, while also presenting updated economic projections through 2025. President Christine Lagarde faces the press half an hour later.

- Follow the ECB TLIV blog here

Rates

Tempering the pace of increases has been well flagged by the ECB, with even some more-hawkish officials like Germany’s Joachim Nagel and the Netherlands’ Klaas Knot signaling they’d be willing to compromise.

A half-point step on Thursday would leave the deposit rate 250 basis points higher than it was in July. It will take time for the economy to digest such a steep rise and Chief Economist Philip Lane has led calls for more gradual steps from here to ensure the ECB doesn’t choke demand excessively.

Traders have listened, looking beyond last-minute calls for a larger move by Governing Council members including Slovakia’s Peter Kazimir. Money markets are pricing an increase of 53 basis points — bets that have in the past influenced decisions themselves by making officials wary of surprising investors.

Economists see the ECB lifting rates to 2.5% in 2023, below the 2.9% peak that markets are betting on. Lagarde is likely to stress that this week’s action won’t be the last, with data to determine future moves.

QT Outline

Lagarde will also announce the “key principles” of how the ECB plans to reduce the stock of bonds it accumulated under the Asset Purchase Program, promising a “measured and predictable” approach.

Precise details and timing will only come later, potentially at February’s meeting. But policymakers have signaled a preference for gradually rolling off maturing debt by halting reinvestments — a strategy already being used by the Fed — rather than selling bonds outright, like the Bank of England.

Opinions diverge on whether to set monthly caps so as not to rattle markets. Lately, the gap between Italian and German 10-year yields — a key risk gauge — has narrowed as Prime Minister Giorgia Meloni pursues investor-friendly fiscal policies.

Even if bond markets struggle, the ECB will probably press ahead with QT as it has backstops in place to deal with any fallout. They include diverting reinvestments from a separate pandemic portfolio to trouble spots, alongside a newly created bond-buying tool if gyrations are deemed to be unwarranted.

Forecasts

The ECB’s new economic outlook will contain a first glimpse of growth and inflation in 2025. After earlier projections gravely underestimated price pressures, the picture so far out will likely be less policy-relevant than in the past. But whether inflation is seen at or below the 2% goal will still color the debate.

Some indicators suggest price growth is peaking, though Lagarde has cautioned against declaring victory too soon, particularly with underlying inflation stubbornly high. The ECB’s wage-growth assumptions will offer some insight into how worried it is about second-round effects.

Also interesting will be whether the economy is seen contracting next year. Analysts surveyed by Bloomberg predict output will drop 0.1%.

Several officials have said any downturn will be short-lived. While a winter recession is inevitable, that view is backed by government support for businesses and households and high stocks of natural gas in Germany, Europe’s industrial heartland and largest economy.

--With assistance from James Hirai.

©2022 Bloomberg L.P.