Aug 4, 2020

Elizabeth Warren seeks SEC insider trading probe after Kodak shares surge

, Bloomberg News

Senator Elizabeth Warren wants U.S. regulators to examine possible insider trading and disclosure violations involving Eastman Kodak Co. after the former film company’s shares soared when it announced a surprise foray into generic drugs with help from a US$765 million government loan.

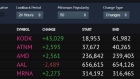

In a letter dated Tuesday, Warren asked the Securities and Exchange Commission to examine trading prior to Kodak’s July 28 announcement. On July 27, volume in the company’s shares surged and the stock rose about 20 per cent. The stock had jumped more than 500 per cent by the end of last week.

“This is just the latest example of unusual trading activity involving a major Trump administration decision,” Warren, a Massachusetts Democrat, wrote.

Kodak rose 15 per cent to US$17.11 at 10:13 a.m. in New York Tuesday, joining a broader rally in U.S. stocks.

Warren conceded that the rise in the stock price on July 27 may have been triggered by news sources in Rochester, New York -- where Kodak is based -- sharing embargoed information about the government loan via Twitter. But she questioned whether such reports could have been prompted by a violation of what’s known as Regulation Full Disclosure, a rule that requires public companies to release material information to all investors at the same time.