Nov 2, 2021

Earnings fuel U.S. stock gains as clock ticks on Fed

, Bloomberg News

2-3 rate hikes in the next 18 months woud be a lot for the economy to absorb: Ryan Bushell

The relentless rally in stocks pushed major U.S. benchmarks to their all-time highs just a day before the Federal Reserve’s policy decision.

Underpinning that strength is the fact that profit margins have held up incredibly well, despite soaring commodity prices and supply-chain snarls. Many companies have been able to pass through rising costs to consumers, with the majority beating earnings estimates. Regardless of what the Fed may say or do Wednesday, there’s a perception the U.S. will still have comparatively low rates, which bodes well for stocks.

“While the upside for equities might be slowing versus what we had seen over the course of the last 18 months, the reality is still that there’s a solid base for risk assets to continue to perform well,” Ian Lyngen, a strategist at BMO Capital Markets, told Bloomberg TV and Radio’s Surveillance on Tuesday.

Treasury two-year yields joined a global slide in short-term rates that was unleashed by the Australian central bank’s dovish statement just a day before the Fed decision. With U.S. policy makers expected to start scaling back their asset-purchase program soon, economists surveyed by Bloomberg are closely divided on whether a rate liftoff will be next year or early 2023.

“The Fed has managed expectations perfectly in terms of preparing the markets for what is likely to be speed tapering,” said Win Thin, global head of currency strategy at Brown Brothers Harriman. “Most officials seem to agree that it’s better to get tapering over as quickly as possible in order to leave the Fed maximum flexibility to hike rates when needed.”

Some corporate highlights:

- Tesla Inc. slipped as billionaire Elon Musk cast doubt on Hertz Global Holdings Inc. plan to buy 100,000 electric vehicles and downplayed the deal’s potential.

- Avis Budget Group Inc. soared amid a flurry of retail-crazed activity as the rental-car company said it will play a big role in the adoption of electric vehicles in the U.S.

- Pfizer Inc. climbed after boosting its forecast for the year on the strength of its COVID-19 vaccine sales. It also projected 2022 revenue for the shot above analysts’ expectations.

- Under Armour Inc. jumped as the athletic-gear maker raised its outlook and reported revenue that beat estimates.

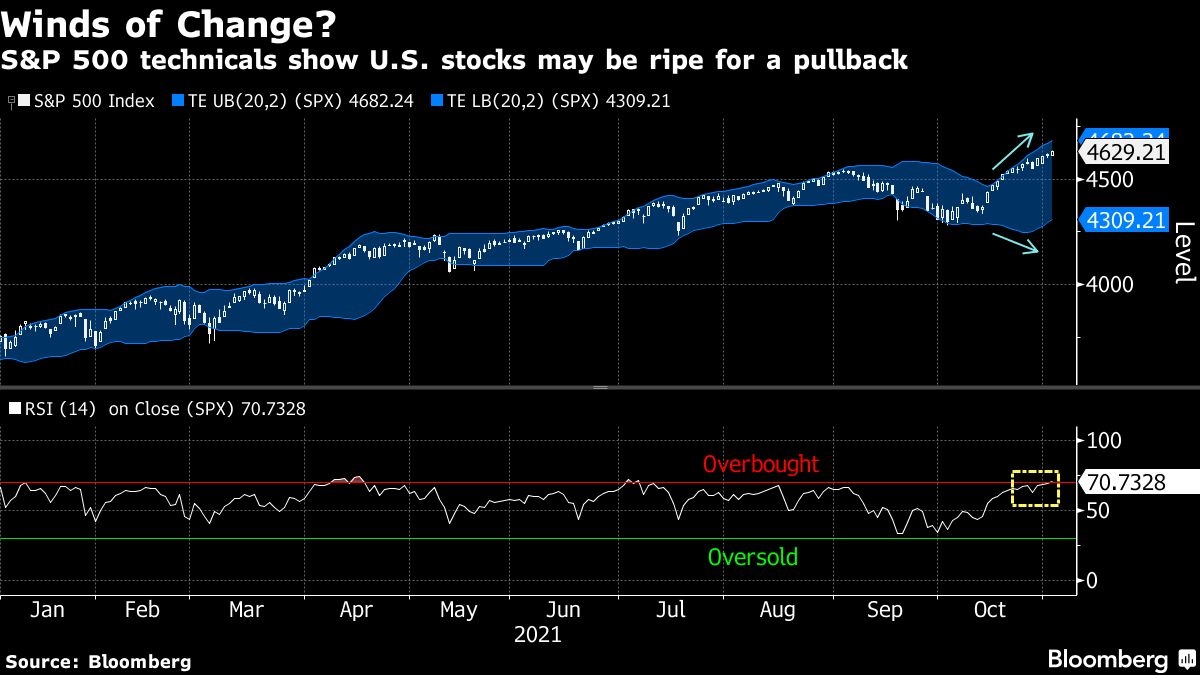

- After the recent rally in equities, technical indicators are signaling heightened volatility. Not only is the S&P 500 pushing the limits of its trading envelope -- built around moving price averages -- but the widening of its upper and lower bands can also be a precursor to greater swings. Furthermore, the gauge’s 14-day relative strength index is around 70, which is seen by some traders as a threshold for being considered overbought.

Some of the main moves in markets:

Stocks

- The S&P 500 rose 0.4 per cent as of 4 p.m. New York time

- The Nasdaq 100 rose 0.4 per cent

- The Dow Jones Industrial Average rose 0.4 per cent

- The MSCI World index rose 0.1 per cent

Currencies

- The Bloomberg Dollar Spot Index rose 0.2 per cent

- The euro fell 0.2 per cent to US$1.1582

- The British pound fell 0.4 per cent to US$1.3616

- The Japanese yen was little changed at 113.95 per dollar

Bonds

- The yield on 10-year Treasuries declined two basis points to 1.54 per cent

- Germany’s 10-year yield declined six basis points to -0.16 per cent

- Britain’s 10-year yield declined two basis points to 1.04 per cent

Commodities

- West Texas Intermediate crude fell 0.6 per cent to US$83.53 a barrel

- Gold futures fell 0.4 per cent to US$1,789.40 an ounce