Sep 21, 2023

Etsy Bulls Bet Stock’s Miserable Run Is Nearing End

, Bloomberg News

(Bloomberg) -- Wall Street is optimistic that the tide may be turning for one of the worst stocks on the S&P 500 Index.

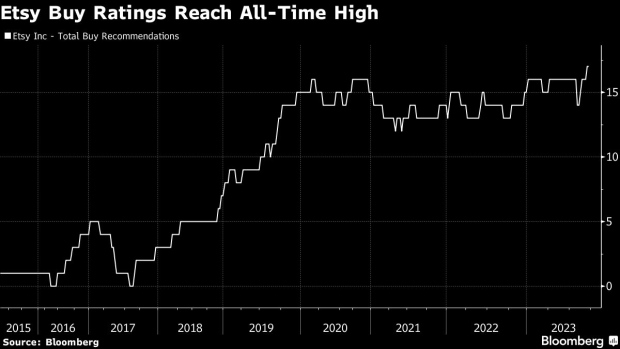

The second-weakest performer on the index since the end of 2021, online marketplace Etsy Inc. is now seeing a record number of analyst buy ratings, while its average price target implies a gain of nearly 70% from current levels, according to data compiled by Bloomberg — after the stock lost more than two-thirds of its value over the past 21 months.

“Etsy may provide a pretty attractive entry point,” said David Klink, senior analyst of equity research at Huntington Private Bank. “We’re starting to increasingly feel like the next driver of growth is going to be diversification in your portfolio, and maybe beefing up some of those bets on underperforming stocks.”

The latest vote of confidence came from Wolfe Research, which raised its rating last week to the buy-equivalent of outperform. Etsy has a number of ways to improve profitability in coming years through rising consumer spending or cost cutting, according to analyst Deepak Mathivanan.

“At a high-level, we think Etsy shares could outperform under various scenarios,” Mathivanan wrote in a research note.

Of course, anyone betting on Etsy in the past two years has been sorely disappointed. After seeing sales surge during the Covid-19 pandemic when homebound shoppers were splurging on home-made face masks and decor, revenue growth has slowed to a trickle. The stock, which hit a record of nearly $300 in late 2021, is headed for its second annual decline of more than 45%.

That contrasts with other e-commerce stocks. An exchange-traded fund that tracks online retailers has rallied this year, lifted by big gains from Amazon.com Inc., Wayfair Inc. and Shopify Inc., which have all advanced more than 60%.

That bifurcation could be related to the bigger-is-better mantra that has prevailed this year amid rising interest rates and uncertainty about the direction of the economy. Unlike Amazon, which has a dominant market position and strong balance sheet, companies like Etsy may be viewed as more niche and discretionary, said Anthony Zackery, associate portfolio manager at Zevenbergen Capital Investments LLC.

Part of the attraction for Etsy bulls, however, is its valuation. At 16 times earnings projected over the next 12 months, the stock is priced well below its average over the past five years of 46 times and at a significant discount to e-commerce peers.

The catch is that Etsy’s revenue growth is a fraction of what it once was. Sales are expected to expand 7% in 2023, compared with an average of 46% over the past five years, according to data compiled by Bloomberg.

Even some bulls are uncertain about when Etsy shares will turn a corner.

“While we see upside in the mid-to-long-term, we also believe Etsy shares could remain range-bound in the near term,” said Evercore ISI analyst Shweta Khajuria, who has an outperform rating on the stock. Khajuria cited macro-economic challenges, competition and higher marketing costs.

Huntington Private Bank’s Klink sees Etsy benefiting from overly pessimistic assumptions about the purchasing power of US consumers and says its depressed valuation makes it compelling.

“That’s worth taking a swing at,” he said.

Tech Chart of the Day

Nvidia Corp.’s selloff in recent days has exposed a widening gap between the stock price and analyst price targets, the average of which show a return potential on the shares of 53%. The distance between the share price and the average analyst target is at a record for the stock.

Top Tech Stories

- Alphabet Inc.’s Google executives are considering dropping Broadcom Inc. as a supplier for artificial intelligence chips as soon as 2027 as the tech giant seeks to develop in-house capacity, The Information reported Thursday, citing an unidentified person familiar.

- Private equity fund Japan Industrial Partners Inc.’s successful tender offer for Toshiba Corp. paves the way for a ¥2 trillion ($13.5 billion) buyout that would end the electronics group’s 74-year-long run as a listed entity.

- Apple Inc.’s major suppliers in Taiwan suffered another double-digit sales decline in August as weak consumer demand dragged down the wider electronics industry.

- Three Amazon.com Inc. executives were accused by the US Federal Trade Commission of participating in an alleged plan to make it difficult for customers to cancel subscriptions to the company’s Prime membership service.

- Instacart, the US grocery-delivery giant that soared by as much as 43% in its trading debut Tuesday, has now wiped out virtually all of those gains as investors question its growth prospects.

Earnings Due Thursday

- Postmarket

- Scholastic

--With assistance from Thyagaraju Adinarayan.

(Updates stock moves at market open.)

©2023 Bloomberg L.P.