Dec 16, 2022

Euro-Zone Business Activity Signals Milder Downturn Than Feared

, Bloomberg News

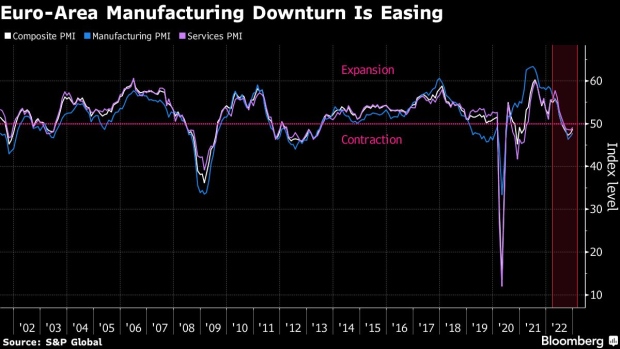

(Bloomberg) -- The euro-area manufacturing downturn is easing as supply-chain snarls abate and inflation slows — signaling the bloc’s economic slump will be less steep than feared.

S&P Global’s flash Purchasing Managers Index rose more than expected in December to 48.8. While remaining below the 50 threshold that separates expansion from contraction, the rate of decline in business activity moderated for a second month.

“While the further fall in business activity in December signals a strong possibility of recession, the survey also hints that any downturn will be milder than thought likely a few months ago,” S&P Global Market Intelligence chief business economist Chris Williamson said.

Gross domestic product in the 19-nation bloc will probably contract “just less than 0.2%” this quarter, according to Williamson, with indications that the rate of decline may ease further in the following three-month period. The previous survey pointed to a drop of just over 0.2%.

European Central Bank President Christine Lagarde said Thursday that the region may experience a “short-lived and shallow” recession this quarter and next but still promised more increases in interest rates following the latest half-point hike. Despite the continuing energy crisis, Europe’s outlook has become a little rosier thanks to optimism over Germany, its top economy.

Germany’s key manufacturing sector improved this month, helped by better supply conditions and receding fears of energy shortages. Only France saw a deepening downturn — driven by the steepest fall in the service sector in almost two years.

British businesses, meanwhile, are bracing for a worsening recession after both the manufacturing and service sectors slumped in the fourth quarter, prompting the first fall in employment in almost two years. The measure of sentiment from purchasing managers rose to 49 in December from 48.2 last month.

What Bloomberg Economics Says...

“The euro-area PMIs will do little to deter the ECB from pushing ahead with additional monetary tightening, in particular another 50-basis-point hike in February. It suggests that the economic downturn being brought on by the surge in energy prices, broad-based inflation and the tightening of financial conditions isn’t especially deep and inflation remains unacceptably high, although it’s decelerating.”

—David Powell, senior euro-area economist. For full React, click here

New orders fell for a sixth month in the euro area as companies continued to report weakening customer demand, though the rate of decline was the softest since August. Combined with better supply, this also led to the slowest rate of increase in input costs since May 2021.

The outlook for inflation is encouraging, Williamson said, though the downside is that this mainly resulted from falling demand that had reduced pricing power among many companies and their suppliers. Business sentiment overall remains subdued.

“There remain few signs of any meaningful return to growth evident as 2022 comes to an end,” Williamson said.

The 19-member euro zone saw consumer prices increase 10.1% in November from a year earlier, according to Eurostat numbers published on Friday. That’s down from 10.6% in the previous month but 0.1 percentage point higher than a preliminary reading.

Read more: Euro-Area Inflation at 10.1% Slowed Less Than Thought Last Month

By sector, the steepest downturns continued to be seen at chemical, plastics and basic-resource firms, as well as in the financial-services sector. There was also a marked fall for transportation, but tourism and recreation improved.

PMI readings for the US later on Friday are likely to show another month of contraction. Australian data published earlier showed its PMI worsened to 47.3 from 48 in November.

--With assistance from Joel Rinneby, Mark Evans, Zoe Schneeweiss and Reed Landberg.

(Updates with UK PMIs in seventh paragraph, euro-zone inflation figures in 11th paragraph)

©2022 Bloomberg L.P.