Mar 2, 2023

Euro-Zone Inflation Barely Slows as Core Gauge Hits Record

, Bloomberg News

(Bloomberg) -- Euro-area inflation slowed by less than anticipated while underlying price pressures surged to a new record, reinforcing expectations that the European Central Bank will have to push borrowing costs ever higher.

Driven by food and services costs, February’s headline figure of 8.5% exceeded the 8.3% median estimate in a Bloomberg survey of economists and compares with an advance of 8.6% in January.

Core inflation — the key focus right now for policymakers — quickened to 5.6% from 5.3%.

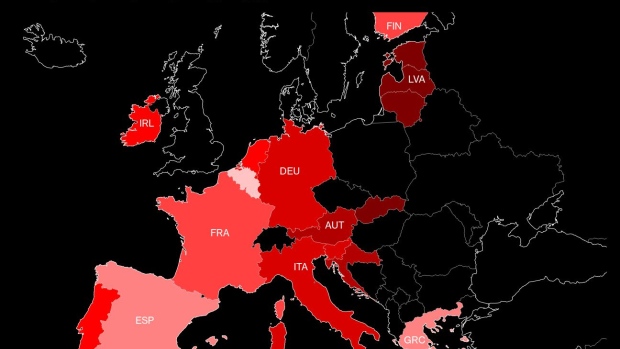

The numbers follow strong consumer-price data earlier this week from Germany, France and Spain that had already wrong-footed economists and prompted investors to bet that the ECB’s deposit rate — currently 2.5% — will reach a peak of 4%.

Money markets maintained wagers for 91 basis points of rate hikes by May, while the euro was little changed against the dollar, trading 0.4% lower at 1.0625.

The spike in energy costs continued to moderate last month after a mild winter eased the crisis unleashed by the war in Ukraine. The effect will become more pronounced in March since prices for oil and natural gas took off after Russia invaded its neighbor just over a year ago.

Policymakers, however, have their eyes glued to the measure that strips out such volatile items. They’re worried that elevated price gains will continue to permeate through the economy and lead workers to seek larger pay rises.

What Bloomberg Economics Says...

“Alongside a slew of hawkish remarks from policymakers, we now expect the ECB to keep hiking until June, taking the deposit rate to 3.5%. By then, core inflation should be on a firmly downward trajectory, creating space to take stock. The risk is that sticky core inflation means borrowing costs are taken further into restrictive territory over the summer.”

—Jamie Rush, chief European economist. Click here for full REACT

The ECB is all but certain to raise borrowing costs by another 50 basis points in two weeks’ time. What happens beyond that is the subject of intensifying debate. ECB President Christine Lagarde told Spanish television earlier Thursday that hikes may need to continue, adding that inflation isn’t on a “stable decline.”

“What’s very certain is that we’ll do whatever’s needed in order to bring inflation back to 2%,” Lagarde said.

Bundesbank President Joachim Nagel said Wednesday that further “significant” steps may be necessary to get inflation under control. While Bank of Italy chief Ignazio Visco agreed that tightening must continue, he urged against pushing too far.

Some analysts have raised their expectations for the peak in borrowing costs in recent days: Both Goldman Sachs and Deutsche Bank now predict the deposit rate will reach 3.75%.

The economy has been relatively resilient to such headwinds. Surveys show an improving mood after the worst-case scenario for this winter was avoided. The jobs market also remains robust, with unemployment historically low.

That’s encouraged demands from labor unions who’re seeking to make up for the loss of purchasing power their workers have sustained. Public-sector employees in Germany want a pay rise of 10.5% — far above what ECB officials consider compatible with price stability.

--With assistance from Joel Rinneby, Kristian Siedenburg and James Hirai.

(Updates with market reaction, Bloomberg Economics starting in fifth paragraph.)

©2023 Bloomberg L.P.