Apr 28, 2023

Euro-Zone Inflation Fluctuations Test ECB as It Weighs Smaller Hike

, Bloomberg News

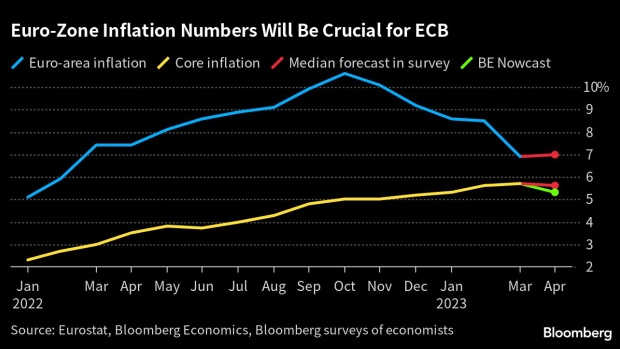

(Bloomberg) -- The slowdown in euro-zone inflation probably reversed course this month while an underlying measure may have weakened, presenting the European Central Bank with conflicting signs just before its key decision.

The headline rate of price growth quickened slightly for the first time in half a year, reaching 7%, according to the median of 33 estimates in a Bloomberg survey. The forecasts show the core gauge — stripping out volatile elements such as energy — probably fell.

Those data will be released on Tuesday, almost exactly 48 hours before ECB officials need to make up their minds on whether to keep up a more aggressive pace of tightening or deliver the smallest interest-rate increase of this cycle — a quarter-point move anticipated by economists.

The possible differences in momentum between each inflation gauge illustrate the challenge for policymakers as they attempt to assess the strength of price growth after 350 basis points of hikes since July.

National data on Friday revealed how the geographic picture is also mixed. Inflation in both Germany and Spain was slower than anticipated, while it unexpectedly accelerated in France.

It’s the core measure that the ECB has honed in on as most important at the current juncture. The median of 5.6% in the Bloomberg survey would remain far above the 2% level in the overall gauge targeted by officials.

“A big upward surprise on core inflation would put the decision over whether to hike by 25 or 50 basis points on a knife edge,” Jamie Rush, chief European economist at Bloomberg Economics, said in a report.

Rush’s forecast is for a slowdown to 5.5% on the underlying measure. BE’s Nowcast model incorporating 32 variables ranging from consumer-price indicators to commodity costs is even more optimistic, projecting an outcome of 5.3%.

--With assistance from Andrej Sokol (Economist) and Bhargavi Sakthivel (Economist).

©2023 Bloomberg L.P.