Mar 6, 2023

Europe Bond Sales Top Half-a-Trillion Mark in Record Time

, Bloomberg News

(Bloomberg) -- European bond sales have topped €500 billion ($532 billion) since the start of the year — the fastest pace on record as uncertainty over inflation and geopolitics prompt companies, banks and governments to overlook rising yields and push ahead with their debt plans.

Offerings from Nestle SA, Toyota Motor Corp and HSBC Holdings Plc on Monday helped beat a previous record by two weeks, according to data compiled by Bloomberg. The tally is set to rise higher with the European Union and Stellantis NV on the list of issuers planning new bond sales this week.

“If we are going to have another volatile year, it’s better to get it done early than wait,” said David Zahn, head of European fixed income at Franklin Templeton. “You don’t know what the rest of the year will be like.”

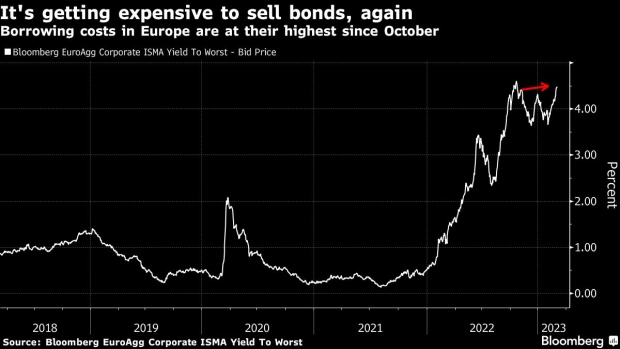

Bond sales picked up at the start of the year as investors speculated that central banks would start to dial back their aggressive run of interest-rate hikes. Now, with Europe’s core inflation rate at the fastest in euro-zone history, issuers are once again having to offer higher yields to sell their debt.

ECB Battle Lines Form for March Decision as Future Hikes Debated

Borrowers will price the equivalent of €14.6 billion in Europe’s debt market on Monday, led by a €5 billion two-part covered bond offering from the Toronto-Dominion Bank that has pulled in more than €6.8 billion of investor demand. A €2.75 billion deal from HSBC has also contributed to the day’s tally.

“Some issuance has been front-loaded this year into a window of strong market conditions,” said Matthew Bailey, executive director of European credit strategy at JPMorgan Chase & Co. “But we think there is still plenty more supply to come.”

--With assistance from Tasos Vossos and Paul Cohen.

©2023 Bloomberg L.P.