Sep 20, 2021

Europe Faces Worst Corporate Credit Supply Shortfall Since 2005

, Bloomberg News

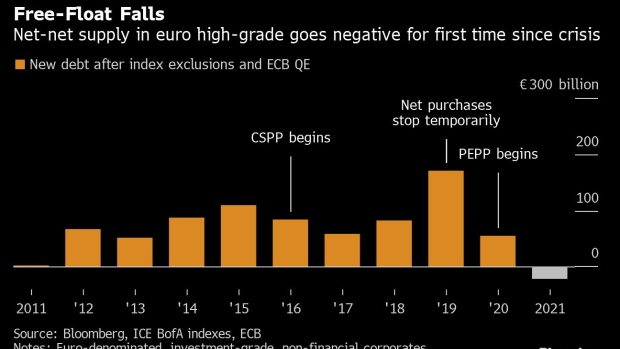

(Bloomberg) -- The amount of corporate bonds investors can trade in Europe is shrinking for the first time since 2005.

Despite a rush in deals by high-grade non-financial firms, there’s effectively a 21 billion-euro ($25 billion) drop in the investable pool of euro bonds because of calls, buybacks, upcoming redemptions and European Central Bank debt purchases, according to Bloomberg calculations.

Dwindling supply will typically limit liquidity in credit markets, making the pricing of risk more challenging. The issue is already prevalent in Europe’s sovereign bond market, where central bank dominance has sapped volatility, crimped trading volumes and squeezed out investors in what’s known as “Japanification.”

“It’s getting to a situation where the credit market will be almost broken,” said James Vokins, head of investment-grade credit at Aviva Investors, which oversees 366 billion pounds ($505 billion). “It won’t be functioning with the liquidity it needs and that could be a concern for next year if the trend continues.”

So-called negative net-net supply is the result of continuing central bank stimulus in a period when companies have limited funding needs after the 2020 debt binge. Firms in the euro area boosted cash reserves during the pandemic and now sit on record-high deposits with banks. Gross supply of euro non-financial bonds has seen a 42% year-on-year drop, according to data compiled by Bloomberg.

Read more: Firms Hoarding Cash Like Never Before Ease Credit Nerves

While the ECB decided last week to slow down the pace of purchases under its pandemic emergency purchase program, or PEPP, the bulk of credit purchases take place under the corporate sector purchase program, known as CSPP, which has been in place since 2016.

Net-net issuance in the euro area is expected to remain negative for most of the fall. Barclays Plc strategists Zoso Davies and Jenny Avdoi forecast negative net supply after ECB purchases in each of this year’s four remaining months, apart from November. That’s even after brisk gross supply of 32 billion euros they’re expecting in September.

Japan’s Example

A far-fetched example of limited free-float can be found in the Japanese government bond market, where the lack of liquidity is so extreme that there were zero trades in the 10-year benchmark one day last month despite there being a bond auction.

A supply comeback could still be in the cards in Europe, as sales over the longer-term will probably increase as companies pare cash piles.

At least for now, negative net-net supply makes it easy for cash-rich investors to absorb the new issuance and helps keep risk premiums in corporate debt near historically low levels. Spreads have flatlined at about 83 basis points since mid-April, based on Bloomberg index data.

Fierce competition for bonds means portfolio managers either have to buy whatever they can at any price or risk getting stuck with idle cash.

“The situation currently in the new issuance market makes it difficult to get paper for a reasonable premium,” said Thomas Neuhold, a portfolio manager at Gutmann Kapitalanlage AG, which oversees 10 billion euros. “You’re trying to set spread limits and effectively end up sitting in cash.”

©2021 Bloomberg L.P.