Nov 14, 2023

Europe Gas Prices Fall on on Strong Supply

, Bloomberg News

(Bloomberg) -- European natural gas eased on Tuesday with the market so brimming with supplies that even the potential shutdown of an LNG plant in Texas isn’t worrying traders for now.

Benchmark futures fell as much as 2.4% on Tuesday, after a modest increase late Monday after news of the issues at the Freeport LNG export plant. Storage tanks that are more than 99% full, and mild weather, are helping reduce price sensitivity.

Read More: Pipeline Flows to Freeport LNG Plant Drop Amid Shutdown Fears

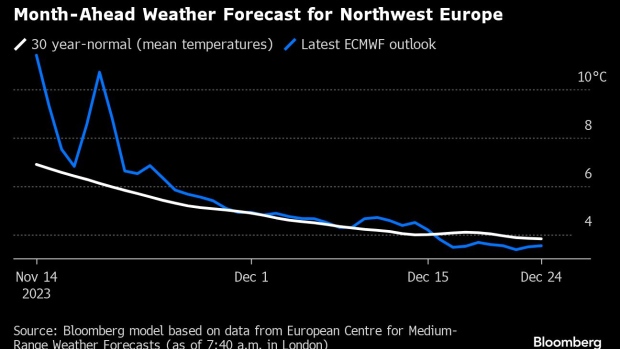

Unseasonably mild weather is expected to extend across much of continental Europe well into late November reducing heating demand, according to forecaster Maxar Technologies Inc. In parts of the UK, storm Debi has triggered weather warnings as it brings strong winds, which have boosted renewable generation in the country, further cutting gas use in the power sector.

Europe’s energy supplies are on far more stable footing than they were at the peak of last year’s energy crisis, even as withdrawals from gas inventories have now started. Storage has reached maximum levels earlier than usual in the season.

Global supply balances remain tight and prolonged supply disruptions or a recovery in industrial demand could tilt the fragile balance. So far this year, extended maintenance in Norway, LNG worker strikes in Australia and the Middle East war have prompted sharp intraday price swings.

Dutch front-month futures, Europe’s gas benchmark, fell 1.37% to €47.22 a megawatt-hour at 9:15 am in Amsterdam. The equivalent UK contract also dropped.

--With assistance from Elena Mazneva.

©2023 Bloomberg L.P.