Jul 14, 2022

Europe’s Price Shock Will Last Longer With Less Growth, EU says

, Bloomberg News

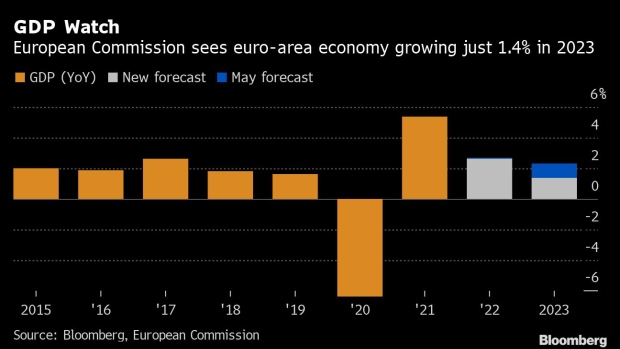

(Bloomberg) -- Europe’s economy now faces a “significantly slower” outlook as well as a bigger and more enduring cost-of-living shock than just two months ago, the European Commission said.

Such are the headwinds posed by fallout from Russia’s war in Ukraine that the Brussels-based executive of the European Union shaved almost a whole percentage point off its forecast for 2023 in new projections published on Thursday.

It also predicts inflation will peak later and persist for longer. The forecasts show a rate of 7.6% in 2022 -- up from 6.1% -- and an average of 4% next year, double the European Central Bank’s goal. The numbers confirm a draft earlier reported by Bloomberg.

“Moscow’s actions are disrupting energy and grain supplies, pushing up prices and weakening confidence,” EU Economy Commissioner Paolo Gentiloni said. “With the course of the war and the reliability of gas supplies unknown, this forecast is subject to high uncertainty and downside risks.”

The new forecasts illustrate the increasingly dire backdrop faced by the ECB as it gears up for its first interest-rate hike in more than a decade next week, and contends with the euro’s first brush with dollar parity since 2002.

The prospect of a more persistent consumer-price shock may be particularly concerning for policy makers in Frankfurt as they gauge whether the extent of inflation lingering in the economy might require more aggressive monetary tightening.

The EU Commission’s revisions were necessary because many of the risks that officials considered two months ago had materialized in the meantime, it said in a statement.

Surging prices for energy and food “are feeding global inflationary pressures, eroding the purchasing power of households and triggering a faster monetary policy response than previously assumed,” it said. “Ongoing deceleration of growth in the US is adding to the negative economic impact of China’s strict zero-Covid policy.”

The forecasts are based on exchange rates of $1.06 in 2022 and $1.05 in 2023, much higher than the euro’s current level close to parity with the dollar. If such a low level were to persist, that could push import costs higher, with a corresponding impact on inflation.

Unlike the last forecast in May, this one doesn’t include a downside scenario. If they materialize, the projections do still suggest a relatively benign path for growth.

“Economic activity in the remainder of the year is expected to be subdued, notwithstanding a promising summer tourism season,” the Commission said. “In 2023, quarterly economic growth is expected to gather momentum, on the back of a resilient labor market, moderating inflation, support from the Recovery and Resilience Facility and the still large amount of excess savings.”

EU officials don’t mention the risk of a recession, but the speed with which their outlook is souring points to that threat becoming more apparent as the year progresses -- especially with the prospect that Russian gas might stop flowing.

Read next: Euro Zone’s Eastern Fringe Probably Already in Recession

With that threat looming, Germany’s Economy Ministry warned on Thursday of a “noticeably clouded outlook” for the rest of the year, noting that a lack of energy would present “major challenges” to the country’s manufacturers.

Investor sentiment in the outlook there is at its lowest since Europe’s debt crisis.

©2022 Bloomberg L.P.