Jan 22, 2024

European Gas and Electricity Prices Tumble as Wind Power Surges

, Bloomberg News

(Bloomberg) -- European energy prices tumbled, with natural gas futures hitting a six-month low as a new Atlantic storm brought unseasonable warmth and boosted wind-power generation.

Benchmark gas futures dropped as much as 6.4%, falling to the lowest since July. Intraday power prices in Germany and France fell below zero for several hours. They turn negative when supply outstrips demand.

Hurricane-force winds brought by Storm Isha are disrupting travel across northern Europe and leading to power cuts in some areas. Still, elevated wind generation offers some respite for the region’s energy supplies after a recent cold blast. Some models point to unseasonably mild weather well into early February.

Read More: Hurricane-Force Winds Cause Chaos, Blackouts Across North Europe

Europe is benefiting from record renewables power installations last year, together with massive gas stockpiling and a relatively mild winter — some cold snaps aside. With temperatures recovering, gas demand for heating and power generation should drop, helping to keep energy prices in check after a recent rebound.

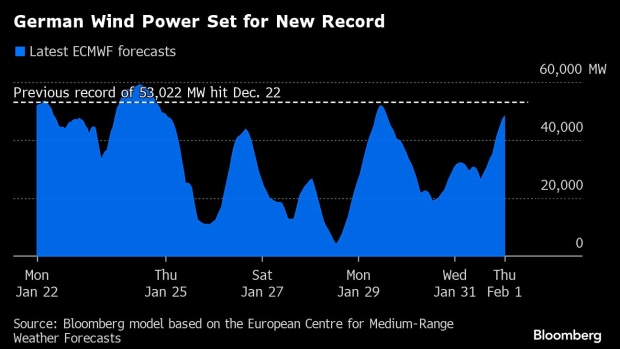

Nordic wind power output surged to a record 25,723 megawatts, according to grid data compiled by Bloomberg. Wind generation in Germany is also on course to hit a new high, topping the previous record reached just before Christmas, according to a Bloomberg model. Wind output in the UK is below the December high, but still covered about 50% of the nation’s total energy mix early Monday, with gas contributing only about 20%, grid data show.

“European natural gas prices have softened significantly mostly because this winter has largely been milder than normal,” according to Citigroup Inc.’s energy research strategists Anthony Yuen and Maggie Xueting Lin. “Europe should get through this winter with enough natural gas in storage.”

Europe Moves Into a New World After a Crippling Energy Crisis

Intraday power fell as low as -€14.88 per megawatt-hour for Germany earlier on Monday, and to -€15.20 per megawatt-hour in France, according to prices on Epex Spot SE. Day-ahead gas prices in the UK dropped as much as 5.3%.

Benchmark Dutch front-month gas traded 4.7% lower at €27.10 a megawatt-hour by 10:35 a.m. in Amsterdam.

The drop comes even though tensions in the Middle East are still running high — a driver that caused a rally in gas prices in October.

“European gas seems to neglect the risk of the Israel-Hamas war escalating into a regional conflict amid robust storage stockpiles, ample supply and weak industrial demand,” Bloomberg Intelligence analyst Patricio Alvarez said in a note.

--With assistance from Rachel Morison, Andrew Reierson and Lars Paulsson.

©2024 Bloomberg L.P.