Apr 16, 2024

Cathie Wood’s ARKK Hits Five-Month Low as Tesla Fuels Losing Run

, Bloomberg News

(Bloomberg) -- Shares in Cathie Wood’s flagship fund slid to a five-month low as Tesla Inc., its biggest holding, dropped after a round of job cuts stoked investors’ worries about the carmaker’s growth prospects.

The decline extends a disappointing run for the $6.7 billion Ark Innovation ETF (ticker ARKK), which has been hit by losses this year as a slew of unprofitable tech firms fall out of favor and investors dial back expectations for interest-rate cuts from the Federal Reserve.

ARKK edged lower by as much as 2.8% Tuesday even as the broader equity market stabilized from a steep two-day selloff. That’s left the actively-managed ETF down about over 16% this year despite a more than 5% gain in the Nasdaq 100 index and a 6% advance in the S&P 500.

That fund’s performance has been dragged down heavily by Tesla, which accounts for nearly 10% of the fund’s holdings and recently reclaimed its status as the fund’s single biggest bet, overtaking Coinbase Global Inc. The carmaker dropped as much as 4.8% Tuesday, leaving it down 37% this year and driving its stock market value to less than half its 2021 peak.

Meanwhile, shares of Coinbase declined by as much as 8% Tuesday after falling 9% in the previous session, though they’re still up some 20% year-to-date. Other top holdings — Roku Inc. and UiPath Inc — also traded lower Tuesday.

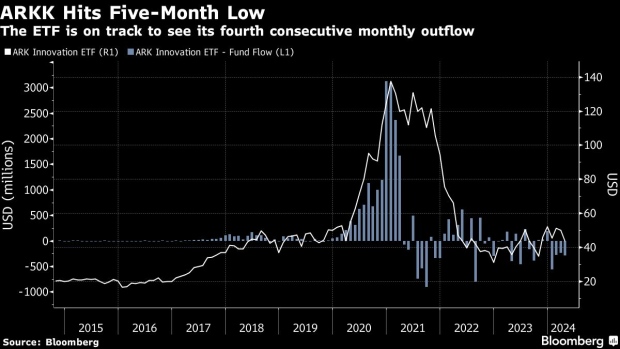

The recent spell has driven investors to yank out cash. The fund is on track for its fourth straight monthly outflow, with $1.4 billion withdrawn this year. During its pandemic heyday, the fund attracted as much as $3 billion in a single month alone.

A representative from Ark did not immediately respond to a request for comment.

“Cathie is an incredible marketer. She put out some very lofty return goals and attracted a ton on inflows,” said George Cipolloni, portfolio manager at Penn Mutual Asset Management. “But ARKK really has not lived up to the hype.”

ARKK charges a 75 basis-point fee. That’s not particularly high for an active fund but steeper compared with passive ones like Invesco QQQ Trust Series (QQQ), which tracks the Nasdaq 100 and charges just 20.

Wood’s ARKK and its entire suite of ETFs from her firm, Ark Investment Management LLC, rose to fame during the pandemic after making big bets on companies working in artificial intelligence, genomics, and gaming, among others. Most of her Ark funds lean into industries where investors have been willing shell out higher valuations on the hope of explosive future growth.

That tactic is coming under pressure as high-priced firms that have yet to post profits lose their allure in a climate of elevated interest rates. The latter is seen as a drag on valuations for growth stocks, since they rely on future profits.

“One of the symptoms of excess liquidity and irrational exuberance is speculative stocks making new highs, but the reverse is also true,” said Chris Zaccarelli, chief investment officer at Independent Advisor Alliance. “As liquidity rushes out of the market and people become fearful, speculative stocks go down the most.”

©2024 Bloomberg L.P.