Mar 28, 2022

European Gas Prices Rise With Colder Weather Outlook in Focus

, Bloomberg News

(Bloomberg) -- European natural gas erased earlier losses amid an outlook for colder weather across much of the continent.

Benchmark futures are trading in a range near 100 euros per megawatt-hour, after an initial burst of volatility following Russia’s invasion of Ukraine last month on top of low European inventories.

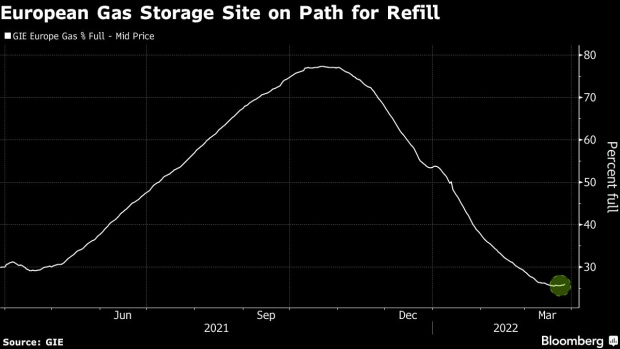

While those storage sites are showing first signs of replenishment, the forecast for lower temperatures during the next two weeks may delay the refill of facilities for next winter.

Also See BNEF: Warming Asia Allows for More LNG Flows to a Chilly Europe

Flows from Russia, which account for about 40% of Europe’s gas demand, have been largely unscathed amid the war in Ukraine. Russian supplies to the continent via key pipeline routes remain steady at a high level, grid data showed on Monday. Russian gas exporter Gazprom PJSC says gas is flowing normally via Ukraine.

Still, Europe is racing to reduce its reliance on Russian energy. The European Union and the U.S., this year’s biggest producer of liquefied natural gas, last week agreed on a deal to increase shipments. The bloc’s leaders also backed the idea of member states jointly buying gas to replenish depleted reserves and obtain lower prices in a tight market.

Read More: EU Leaders Endorse Joint Purchases to Replace Russian Gas

“We expect to continue to see news and comments from heads of state in Europe on changes to Europe’s energy mix, but we acknowledge that substituting Russian energy is likely to be a challenge in the near term,” Moscow-based Sova Capital Ltd. said in an emailed note.

European Efforts

France is looking to build a new floating LNG import terminal in Le Havre, Les Echos reported Monday. Croatia plans to expand its existing facility, while others from Germany to Estonia are pushing for more plants to access LNG and sever links to Russian gas.

Italy’s Eni SpA, a major buyer of Russian gas, said it can replace all of that supply in a few years, according to Chief Executive Officer Claudio Descalzi. Half of the Russian shipments can be replaced already next winter, and up to 80% the following winter, he said during a panel discussion in Dubai. Italy also counts on supplies from its own fields.

Norway, Europe’s second-biggest gas provider, has also been taking measures to boost output of the fuel. Aker BP and its partners in the Skarv license decided to stop injecting gas for oil production and will export the increasing gas volumes instead.

Dutch front-month gas futures traded 3.2% higher at 104.50 euros a megawatt-hour by 11:41 a.m. in Amsterdam. The U.K. contract rose by 6.3%.

©2022 Bloomberg L.P.