Jan 27, 2023

European Mortgages Tumble 70% to Lowest Since Covid on Rate Jump

, Bloomberg News

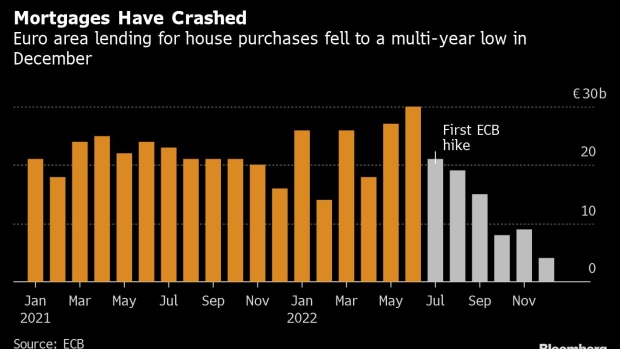

(Bloomberg) -- Europe is facing a rapid contraction of mortgage lending as a jump in interest rates cause financing costs to surge, all but wiping out demand.

Loans for house purchases fell below €5 billion in December, a 70% decline on from the previous year, according to data from the European Central Bank. It’s the first time home loans have fallen below that level since the the onset of the Covid-19 pandemic almost three years ago.

The decline highlights the tense situation in Europe’s market for residential real estate after the end of the era of cheap money. Buffeted by surging costs for food and energy, consumers now face mortgage rates that have sometimes tripled over the past 12 months, making a home purchase unaffordable for many.

Read More: Europe Is Bracing for a Sharp, Abrupt Real Estate Reversal

The sagging demand has started affecting home prices, with Germany last month experiencing the first drop in residential home valuations in over a decade.

©2023 Bloomberg L.P.