May 23, 2022

European Stocks Rise as Valuations Outweigh ECB Policy Concerns

, Bloomberg News

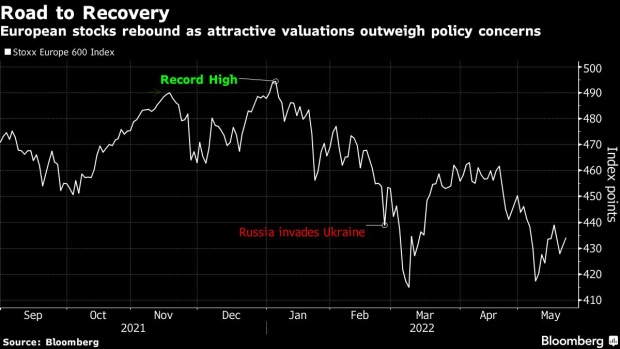

(Bloomberg) -- European equities gained as enticing valuations outweighed concerns about tighter policy and slowing growth.

The benchmark Stoxx 600 rose 1.3% by the close in London, with banks, miners and energy leading gains as commodities climbed. Sentiment was also supported as US President Joe Biden said China tariffs imposed by the Trump administration were under consideration.

European stocks have come under pressure this year amid a flurry of concerns spanning hawkish central banks, slowing growth, soaring prices and the war in Ukraine. Following the dip, the Stoxx 600’s 12-month forward price-to-earnings ratio is trading at about 12.5 times, near the lowest since March 2020.

“Chances are increasing that we see a short-term relief rally into June given bearish sentiment and positioning,” said Ulrich Urbahn, head of multi-asset strategy and research at Berenberg. There should also be “some support for equities from share buybacks and fund rebalancings.”

Stocks earlier pared gains after European Central Bank President Christine Lagarde said the regulator is likely to start raising interest rates in July and exit sub-zero territory by the end of September, amplifying concerns central banks could hurt the economy while combating soaring prices.

“Central bankers seem fairly sure about near-term policy direction, but markets seem quite bad at hearing or understanding them,” said Paul Donovan, chief economist at UBS Global Wealth Management.

Among individual movers, Kingfisher Plc rose as much as 4.9% after saying it will buy back 300 million pounds ($377 million) of stock and that revenue is above pre-pandemic levels. Meanwhile, Siemens Gamesa Renewable Energy SA rallied as much as 6.7% after Siemens Energy AG made an offer to acquire the shares in the wind-turbine maker it doesn’t own.

MARKETS

- Equities: Euro Stoxx 50 up 1.4%, FTSE 100 up 1.7%, DAX up 1.4%, CAC 40 up 1.2%, FTSEMIB up 0.2%, IBEX 35 up 1.7%, AEX-Index up 1.6%, Swiss Market Index up 1.4%

- Bonds: German 10-year-yield up 6bps at 1.01%, Italian 10-year-yield up 2bps at 3.03%, Spanish 10-year-yield up 4bps at 2.13%

- Credit: iTraxx Main down 3.8bps at 96.4, iTraxx Crossover down 15.4bps at 472.6

- FX: Euro spot up 1.08% at 1.0678, Dollar index down 0.96% at 102.16

- Commodities: Brent crude up 0.6% at $113.2/bbl, copper up 1.3% at $9,546/MT, iron ore down 0.1% at $134.29/MT, gold up 0.4% at $1,854.04/oz

EUROPE EQUITIES

- 20 out of 20 Stoxx 600 sectors rise; autos sector has the biggest volume at 123% of its 30-day average; 482 Stoxx 600 members gain, 113 decline

- Top Stoxx 600 outperformers include: Virgin Money UK +8.2%, Powszechny Zaklad Ubezpieczen +7.2%, Deutsche Bank +7.0%, Commerzbank +6.6%, Siemens Gamesa Renewable Energy +6.2%

- Top Stoxx 600 underperformers include: Vifor Pharma -8.2%, ROCKWOOL -5.3%, Schibsted -5.0%, UCB -4.6%, Adevinta -4.4%

- For a daily wrap highlighting the biggest movers among EMEA stocks, click here

- You want more news on this market? Click here for a curated First Word channel of actionable news from Bloomberg and select sources. It can be customized to your preferences by clicking into Actions on the toolbar or hitting the HELP key for assistance.

©2022 Bloomberg L.P.