Jul 9, 2021

Billions flow to even most-expensive funds in ETF cash flood

, Bloomberg News

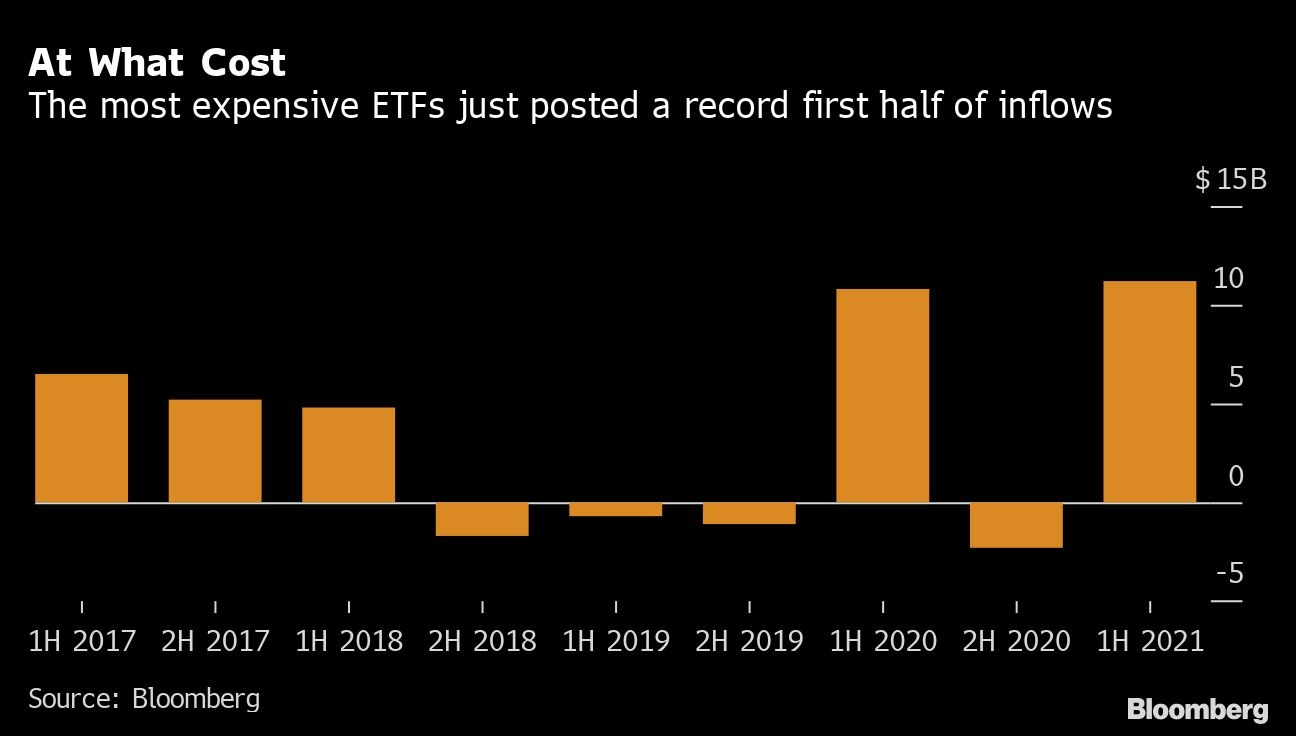

This year’s enthusiasm for exchange-traded funds is so intense that even the most-expensive varieties are raking in cash.

Products charging 0.81 per cent or more lured US$11.2 billion in the first six months of 2021, according to data from Bloomberg Intelligence. Those are at the upper end of the pricing spectrum -- an average active equity ETF charges around 0.7 per cent, and a typical passive one 0.5 per cent. For fixed-income, it’s even cheaper.

The intake for pricey funds was the best-ever in a half-year period -- and a massive rebound from the US$2.3 billion they lost in the last six months of 2020.

It’s slight compared to the US$475 billion lured by all ETFs this year -- easily on course for a record -- but is testament to the ferocious appetite for products from the US$6.5 trillion industry. As the economy recovers from the pandemic, investors are rushing to take part in the rebound.

“The ETF industry is looking more like a barbell,” said Nate Geraci, president of the ETF Store, an advisory firm. “On one end, we’re continuing to see monster flows into the lowest cost beta products. But on the other end, higher cost products with significant value propositions that do something different than a plain vanilla index are also seeing strong investor demand.”

“The ETF industry is looking more like a barbell,” said Nate Geraci, president of the ETF Store, an advisory firm. “On one end, we’re continuing to see monster flows into the lowest cost beta products. But on the other end, higher cost products with significant value propositions that do something different than a plain vanilla index are also seeing strong investor demand.”

The slate of pricey products attracting the most money reveals much of that demand is for high-risk, high-reward bets.

Three leveraged funds -- the ProSharea Ultra VIX Short-Term Futures ETF (ticker UVXY), the Direxion daily Semiconductors Bull 3x Shares ETF (SOXL) and the ProShares UltraPro Short QQQ (SQQQ) -- have each taken in more than US$900 million this year.

Meanwhile, as investors look to cash in on a boom in raw materials, the Invesco DB Commodity Index Tracking Fund (DBC) and the First Trust Global Tactical Commodity Strategy Fund (FTGC) lured US$690 million and US$1.3 billion, respectively.

The slate of pricey products attracting the most money reveals much of that demand is for high-risk, high-reward bets.

Three leveraged funds -- the ProSharea Ultra VIX Short-Term Futures ETF (ticker UVXY), the Direxion daily Semiconductors Bull 3x Shares ETF (SOXL) and the ProShares UltraPro Short QQQ (SQQQ) -- have each taken in more than US$900 million this year.

Meanwhile, as investors look to cash in on a boom in raw materials, the Invesco DB Commodity Index Tracking Fund (DBC) and the First Trust Global Tactical Commodity Strategy Fund (FTGC) lured US$690 million and US$1.3 billion, respectively.

Cathie Wood’s slate of actively managed products are a tad cheaper but still pricey. Her flagship ARK Innovation ETF (ARKK) costs 0.75 per cent and has managed to attract almost US$7 billion so far in 2021, the ninth biggest total across the industry.

“It is also reflective of the move towards actively managed ETFs,” said Ben Johnson, Morningstar’s global director of ETF research. “You have seen that manifest into large flows recently into the Ark family of ETFs, which charge fees many multiple of those total stock market and bond market trackers.”

Two-thirds of all ETFs have taken in fresh cash this year, according to a report from Bloomberg Intelligence. It’s one reason that new funds have been launching at a breathless pace, while closures have been rare.

Overall, cheap prices seem to remain the biggest magnet for investors. Almost US$254 billion -- more than half the total inflows this year -- has flocked to products charging 0.1 per cent or less.

“I don’t think low-cost, broad-based market trackers are in any way affected by what we see going on in relatively more expensive ones,” Johnson said. “It’s in many cases a different investor base.”