Mar 24, 2022

Experts See China Stuck in a Slowly Evolving Covid-Zero Loop

, Bloomberg News

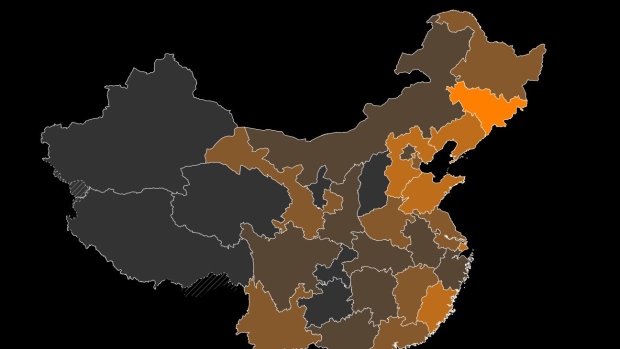

(Bloomberg) -- After conquering Covid-19 for almost two years with a zero-tolerance approach, China is now in the midst of its worst wave since the initial outbreak in Wuhan. Having breached what’s arguably the world’s toughest containment regime, omicron — the most infectious coronavirus variant — is starting to test Beijing’s Covid Zero resolve.

Despite President Xi Jinping’s call mid-March to limit the economic and social fallout of virus elimination, large-scale lockdowns and mass testing drives are back. Authorities are tweaking rules, however, to make some of the measures more flexible, targeted and nimble to avoid severe manufacturing disruptions. Still, the last Covid Zero holdout isn’t in a hurry to abandon the policy, even as the rest of the world moves to treating it as endemic.

Read more:

- World Economy Faces Supply Hit as China Battles Covid Again

- China Finds Way to Do Covid Zero While Keeping Factories Open

- China Locks Down More Than 45 Million People as Covid Returns

- How Hong Kong Went From Covid Zero to World’s Deadliest Outbreak

As the latest wave puts pressure on already shaken global supply chains, we asked experts — including some we spoke to in November — how long the world’s No. 2 economy can continue an approach that’s leaving it increasingly isolated. Many stuck to their previous assessment that Beijing won’t ease curbs and open up this year. Some said China’s virus strategy could become more practical, learning from Hong Kong’s current virus crisis triggered by the pathogen evading strict border curbs and then not being adequately contained once inside.

The Health Experts

Conditions are not yet right for China to reopen because of low vaccination rates among the elderly and a healthcare system that’s inadequate, said Chen Zhengming, an epidemiology professor at the University of Oxford.

Chen predicts further tweaking of the approach but no major changes, with the overall goal remaining the same “for a long time” — echoing his observation last year. China would face a “colossal outbreak” on a scale beyond anything any other country has yet seen, if it were to reopen in a similar manner to the U.S., a study by Peking University showed in November.

“I think the government is also in some way trying to procrastinate, betting on the virus becoming milder in the next few months, which is not unreasonable,” Chen said. “That’s when reopening will be less costly.”

Huang Yanzhong, a senior fellow for global health at the New York-based Council on Foreign Relations, also reiterated his previous stance, saying no change is likely at least until after the 20th National Congress of the Communist Party later this year, where Xi is expected to secure a record third term as the nation’s top leader.

The review of Covid Zero is no longer a public health decision, but a political one, and leaders would want to be sure reversing course is politically safe, Huang said. The new willingness to be flexible, which is long overdue, shows “they have realized it’s impossible to eliminate the virus and have to address complaints about excessive Covid curbs, especially from the country’s big cities,” he said.

Still, the adjustments being made in places like Hong Kong — which is easing some travel and social-distancing curbs despite a high caseload — shows authorities are being more practical, said Jin Dong-yan, a virologist at the University of Hong Kong. Big cities “may still go back to Covid Zero, but how long would be the biggest challenge,” he said.

What many experts said in November: This Is How Long Experts Think China Will Stick With Covid Zero

The Political Observers

George Magnus, a research associate at Oxford University’s China Centre, said his views on how China’s Covid policy will play out are little changed from when he spoke to Bloomberg News in November.

“I still don’t see any meaningful change in the current policy until after the Party Congress, perhaps not until 2023,” he said. “Closed borders are a pain and exact major costs, but I’m not sure the government is so viscerally opposed to this idea.” Altering course will be tough until China has effective mRNA vaccines, he added.

Rolling out booster shots to the vast majority of China’s 1.4 billion people, especially the elderly, may help Beijing — always averse to disruption that could lead to social unrest — feel more confident about opening up. A recent Hong Kong study showed three doses of the domestically developed Sinovac Biotech Ltd. vaccine rolled out to millions in China can be equally effective in preventing death and severe disease as the mRNA shots made by firms such as BioNTech SE.

Allowing manufacturers flexibility amid Covid Zero might only go so far, as other parts of the economy, such as the services sector, will continue to suffer as a result of the curbs in place, Magnus said.

Frank Tsai, a lecturer at the Emlyon Business School’s Shanghai campus and founder of consulting firm China Crossroads, said that the government is “still extremely reluctant to let case counts rise.”

Beijing needs to educate people of the inevitability of rising infections and dispel fears associated with it before it can truly loosen up on Covid Zero, according to Tsai. That hasn’t happened yet. Top health officials have reiterated omicron is far worse than the flu and continue to say publicly that letting the virus roam free will cause substantial illnesses and deaths.

The Market Watchers

The leeway granted to factories amid lockdowns and Xi’s new mantra don’t mean China is dismantling Covid Zero, according to Bruce Pang, head of strategy and macro research at China Renaissance Securities Ltd.

“China will stick to its zero-tolerance approach,” Pang said. Phrases in its statements “that China shouldn’t waver in fighting the virus imply any adjustment will come with the pre-condition of eliminating infections.”

But this may mark the beginning of a gradual change in rhetoric from Beijing, allowing time for people to understand that “the new form of Covid is not that dangerous,” said Vitaly Umansky, a Hong Kong-based analyst at Sanford C. Bernstein. “This will be a multi-month process where the dialog around what Covid is, how dangerous it is, and what it really means needs to change before you can start having a radical change of policy.”

China’s past battle against Covid has had relatively little impact on the global supply chain, but omicron’s widespread penetration of manufacturing hubs means bigger risks from a rigid adherence to Covid Zero, Umansky said, adding it explains why Shenzhen eased quarantine rules quickly, even though it still has cases. “When you go into lockdown, it just becomes a huge problem,” he said.

The Economists

Beijing can’t drop Covid Zero, at least not before the Communist Party summit later this year, according to Alicia Garcia Herrero, chief economist for Asia Pacific at Natixis SA. “A large Covid wave which increased the number of cases massively in China would be too costly politically,” she said.

Still, Xi’s recent adjustment could be the result of “a real power struggle” between Beijing and local governments, which have had to spend more on instituting curbs at a time when they are getting less from the central government and land sales amid a property downturn, she said.

A recent politburo meeting called for stricter implementation of Covid control measures while minimizing the impact on the economy, suggesting the dynamic Covid Zero approach will last longer, said Ding Shuang, chief economist for Greater China and North Asia at Standard Chartered Bank. Ding told Bloomberg News in November that the policy could stay in place at least until March this year. How much longer it will last depends on the vaccination rate of the elderly, availability of effective medicines and preparedness of the medical system for a spike in cases, Ding said.

Tweaks to Covid Zero, similar to those announced in Hong Kong on reducing quarantine for inbound travelers, could also be introduced as part of an effort to help the economy, Ding said.

When China eventually reopens, it will do so cautiously, as the country can’t afford social unrest caused by the inevitable surge in hospitalizations and deaths, said Eric Zhu, an economist covering China and Hong Kong at Bloomberg Economics.

Hong Kong’s experience will be informative, he said.

The Travel Professional

The dynamic Covid Zero policy will need to adapt because the economic costs are increasing, said Gary Bowerman, director of travel and tourism research firm Check-in Asia. The current Covid situation in mainland China doesn’t suggest a reopening is imminent, he said.

“I think China will open up in a gradual and phased manner,” Bowerman said. “Hong Kong and Macau are the priorities in the near future. Setting a hard date is pretty tricky.”

©2022 Bloomberg L.P.