Mar 2, 2022

Exxon deplores Ukraine attack, begins Russia exit, CEO says

, Bloomberg News

Russia's war on Ukraine will have lasting consequences on Europe's gas market: GasVista

Exxon Mobil Corp. has begun work to terminate its decades-long relationship with Russia due to international sanctions and the nation’s “needless destruction” in Ukraine, said Chief Executive Officer Darren Woods.

The process of ending operations before eventually exiting its stake in the Sakhalin-1 oil development will be “complicated” and require careful management, Woods said during the company’s annual Investor Day event on Wednesday. The asset is valued on Exxon’s books at about US$4 billion and makes up 1 per cent to 2 per cent of earnings and capital employed.

“As the operator of Sakhalin-1, we have a significant responsibility to make sure that that operation is run safely, and the integrity of the environmental performance and the operations itself is sound,” Woods said. “That will be a very thoughtful process, working with our co-venturers to make sure that that operation is handed over successfully and without incident.”

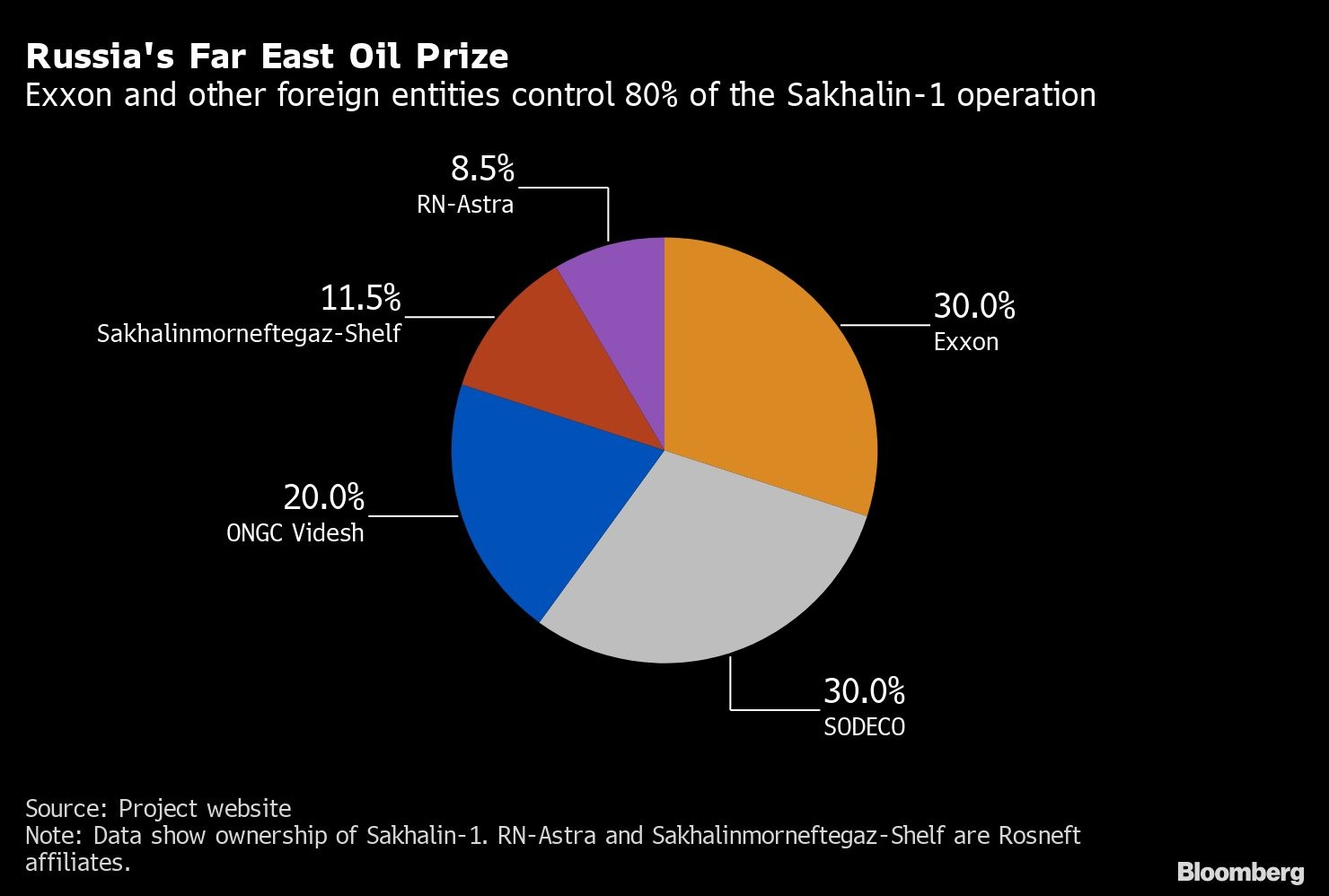

Over the longer term, Exxon will develop the steps required to exit its 30 per cent stake in Sakhalin-1, Woods said. The oil giant pledged to make no new investments in Russia as a result of its invasion of Ukraine.

Sakhalin-1 was an engineering marvel when Exxon first starting pumping barrels from its sub-Arctic fields in 2005, requiring miles-long wells drilled horizontally from the shore to deep beneath the seabed. It produced some 227,000 barrels a day last year and has two ice breakers to maintain exports during the winter, when temperatures reach below -40 degrees Celsius.

But over time, Russia has become less important within Exxon’s global portfolio. Previous rounds of sanctions dating back to Russian interference with Ukraine in the previous decade forced Exxon to abandon an exploration partnership with Rosneft PJSC that had formed the cornerstone of former CEO Rex Tillerson’s growth plans.

The most-recent sanctions and export controls make operating in Russia untenable, Woods said.

“We expect with time, the ability to continue to operate and sustain the integrity of those operations will degrade,” he said. “It will require a discontinuation of operations or a suspension.”

Exxon’s stock rose 2.6 per cent to US$81.20 at 11:38 a.m., extending the year-to-date increase to 33 per cent.