Oct 21, 2022

Exxon Shares Hit Record High as Energy Sector Outperforms

, Bloomberg News

(Bloomberg) -- Exxon Mobil Corp. hit an intraday record high as investors pile into energy equities, undeterred by a recent slump in oil prices.

Shares surged 2.2% to a high of $106.16 Friday, extending a five-day rally. Energy equities were the market’s top-performing sector. Exxon is re-testing highs the supermajor hit June 8, when West Texas Intermediate oil prices stood at $122 a barrel.

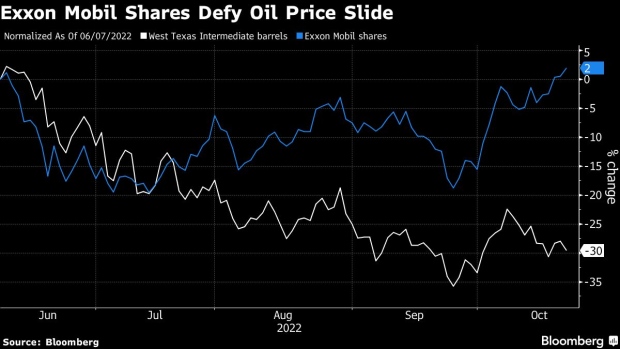

Exxon has been the top-performing stock in the S&P 500 Energy Index since June, when oil and gas producers swooned. The stock has gained value despite a 29% drop in crude oil prices since June 8 driven by fears that central bank efforts to slow down inflation around the world will tip the global economy into a recession. Wall Street is split on how much higher the shares can rise.

Ahead of Exxon’s earnings next week, Jefferies LLC analyst Lloyd Byrne tagged the stock with a Street-high $133 per share price target on Oct. 18 as he sees an attractive outlook “particularly for generalists needing energy exposure.”

Exxon shares pared gains to trade at $105.57 at 11:46 a.m. in New York, which would mark a closing high if the gains hold.

The stock has 15 buy ratings, 15 hold ratings and one hold and it has a 12-month average price target of $108.69, representing 3.4% potential upside.

©2022 Bloomberg L.P.