Jun 13, 2021

Fed Dot Plot Seen Shifting to 2023 Rate Liftoff, Economists Say

, Bloomberg News

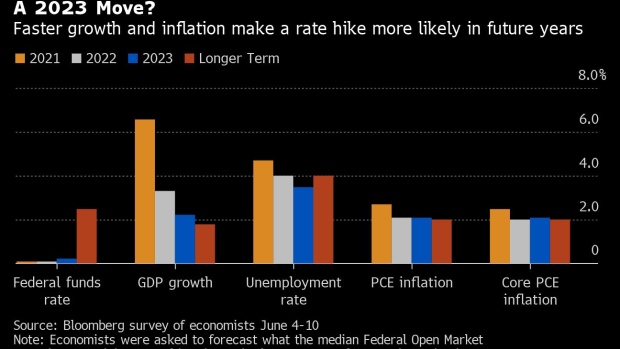

(Bloomberg) -- Federal Reserve officials this week could project interest-rate liftoff in 2023 amid faster economic growth and inflation, but they won’t signal scaling back bond purchases until August or September, according to economists surveyed by Bloomberg.

More than half predict the quarterly rate-forecast “dot plot,” released after the conclusion of the Fed’s two-day policy meeting on Wednesday, will show the median of 18 officials penciling in at least one 2023 increase. The remainder see no liftoff from near-zero rates until 2024 at the earliest, mirroring the Fed’s forecast in March.

The survey of 51 economists was conducted June 4-10.

Even so, the poll respondents see no rush by the Fed to scale back monetary stimulus. Some 40% expect the Fed to take its first step toward tapering its current $120 billion in monthly bond purchases in late August.

That’s when Chair Jerome Powell could give an early signal at the Fed’s Aug. 26-28 policy retreat in Jackson Hole, Wyoming, if he follows tradition and speaks there again this year. Another 24% see that happening the following month.

The Federal Open Market Committee is expected to reaffirm plans to only adjust purchases once the U.S. economy achieves “substantial further progress” toward its employment and inflation goals in its policy statement released at 2 p.m. Washington time on Wednesday. Nor is the Fed expected to raise the target of its benchmark rate from a zero to 0.25% range. Powell will hold a virtual press conference 30 minutes later.

Quarterly forecasts are likely to show the FOMC’s economic-growth outlook raised to 6.6% for 2021 and inflation estimate increased to 2.7% for this year and 2.1% in 2022. The unemployment rate may fall to just 4.7% by the fourth quarter this year, a slower pace than seen in March, the economists concluded.

“The Fed continues on its easy path as unemployment remains above its target and progress on lowering the unemployment rate is slow,” said John Silvia, founder of Dynamic Economic Strategy.

Employment increased by 559,000 last month, less than economists expected, and the unemployment rate edged down to 5.8%.

A number of Fed officials including Vice Chair Richard Clarida have said the committee may discuss tapering “in upcoming meetings” depending on the flow of data. A couple, including Dallas Fed chief Robert Kaplan, have urged the discussion start “sooner rather than later.”

The survey shows a Wall Street consensus is building for some kind of hint of scaling back bond buying at the Kansas City Fed symposium at Jackson Hole. That’s a bit more specific than the April survey, which showed a plurality expected a third-quarter signal.

Economists are split on when the actual tapering announcement is most likely, with one-third predicting September and another third saying December.

“The Fed will continue to signal patience on rate hikes and tapering, despite the recent pick-up in inflation and inflation expectations,” said Scott Anderson, chief economist of Bank of the West. “The Fed will acknowledge, however, that it is making good progress toward its goals.”

Recent economic data have supported the Fed’s view of a robust rebound this year, with unemployment dropping and inflation topping its 2% goal. While the FOMC has been intentionally vague on how it will define “substantial further progress,” economists in the survey expect tapering to start when the unemployment rate is around 5% with inflation at 3%, as measured by the personal consumption expenditures price index.

Beyond the taper, the central bank is likely to be patient in raising rates. Rates are likely to rise by a quarter point by the end of 2023 and another half point by the end of 2024, according to the median respondent in the survey.

Recent higher inflation numbers have shifted the risks to the economic outlook, according to the economists. In June, about 65% saw the concerns mostly about overheating, 22% as evenly balanced and only 12% to the downside. An accelerated U.S. vaccination program, fiscal stimulus and President Joe Biden’s proposed spending on an infrastructure and jobs plan all create the risk of overheating, in the view of economists.

Powell’s current term as Fed chair expires in February. Around three-quarters of the economists expect Biden to keep him in the job, an overwhelming number that’s broadly unchanged from the April survey. Powell has deflected all questions on whether he’d serve four more years if asked, leaving the impression intact that he’d like to stay at the helm.

Fed governor Lael Brainard is seen as the most likely alternative choice by Biden, chosen by 19% of economists. Brainard is as dovish as Powell and is a Democrat, unlike him. She served in the Treasury Department under former President Barack Obama.

©2021 Bloomberg L.P.