Dec 16, 2022

Fed Officials Reinforce Hawkish Message on Need for Higher Rates

, Bloomberg News

(Bloomberg) -- Federal Reserve officials, hammering home an unapologetically hawkish message, said that they won’t relent on tighter policy until inflation is under control.

New York Fed President John Williams, San Francisco Fed chief Mary Daly and Cleveland’s Loretta Mester all stressed the central bank’s commitment to lowering inflation back to their 2% target and the need for clear evidence of easing price pressures.

“We’re going to have to do what’s necessary,” Williams said Friday during an interview on Bloomberg Television with Kathleen Hays.

Referring to the central bank’s forecast that rates will peak above 5% next year, he said “it could be higher than what we’ve written down” if that’s what it takes reduce inflation.

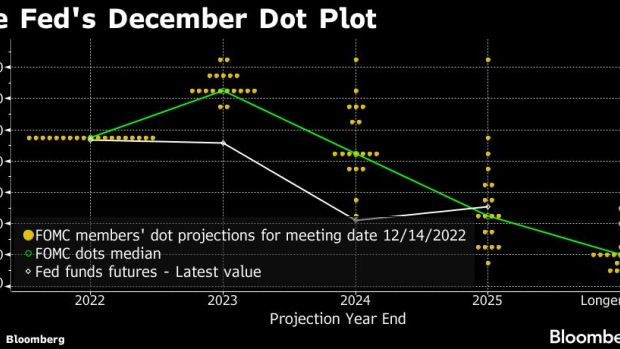

Fed officials lifted interest rates by a half percentage point on Wednesday, bringing their benchmark to a target range of 4.25% to 4.5%. They also released forecasts showing rates ending next year at 5.1%, according to their median forecast, with no rate cuts before 2024.

“To me, the question of how high we have to get to is really going to depend on what we see in inflation and the supply-and-demand imbalance,” he said, while playing down the forecasts of some Fed watchers that rates may need to go to 6% or even 7%.

“That is definitely not my baseline,” Williams said. “I think we have some favorable developments under way – things that we’ve been talking about for a long time,” he added, citing easing supply-chain snarls and softer prices for goods and imports.

“Where inflation is still high is in these core-services areas — the areas that are probably going to be more persistent and really reflect the imbalance between supply and demand,” he said. “We definitely need to see it coming down to get to that 2% inflation goal.”

This week’s rate move marked a downshift by the Fed following four consecutive 75 basis-point hikes that have boosted rates at the fastest pace since the 1980s.

But Chair Jerome Powell made it clear more increases are coming, saying Wednesday that officials still have a “ways to go” before rates are at a level that is sufficiently restrictive to tame inflation running at three times their 2% goal.

“My own outlook is that we will have to keep the funds rate up above 5% next year, until we get inflation moving back down on that consistent basis and then we can move into the next phase,” Cleveland’s Mester said later during a separate interview on Bloomberg TV with Michael McKee.

She said her own estimate for peak rates was “a little higher” than the median projection because she sees more inflation persistence than other officials.

Even so, investors bet that the Fed will only lift rates to a peak of around 4.85% in 2023 and quickly reverse course, lowering by 50 basis points by the end of that year.

Mester pushed back on a date-based approach to when the Fed could start taking its foot off the brake.

“The exact timing of when it will be appropriate to move rates down really is not tied to a calendar,” she said. “It’s tied to ‘have we seen evidence, and good evidence, that inflation is on that sustained downward path to 2%?’”

One explanation for this tension between the Fed and Wall Street is a bet – buoyed by two months of better-than-expected readings on consumer prices — that inflation falls faster than the central bank expects.

San Francisco Fed chief Daly said markets look like they are pricing for “perfection” while she wants evidence that price pressures are easing.

“I don’t quite know why markets are so optimistic about inflation,” she said during a virtual discussion hosted by the American Enterprise Institute.

“We don’t have the luxury of pricing for perfection because we have a price stability mandate, and so we have to imagine what the risks to inflation are, and to me they still are on the upside.”

The Fed’s latest forecast shows its 19 officials projecting rates ending 2023 in a range from 4.9% to 5.6%, with 17 at 5.1% or above.

Daly wasn’t explicit about how high she favors raising rates next year, but spelled out that it was more hawkish than the market because there’s no room for doubt over Fed resolve to restore 2% inflation.

“That means that I have a tighter path of policy, a higher terminal rate, or a higher peak rate for the funds rate, I have it held longer than some of the bond investors would have predicted,” she said. “That’s what I think we’re going to need to do at this point, right now, in order to bring price stability back.”

--With assistance from Sophie Caronello.

(Updates with comment from Mester in 11th paragraph.)

©2022 Bloomberg L.P.