Jan 18, 2023

Fed’s Bullard Says US Rates ‘Almost’ in Restrictive Territory

, Bloomberg News

(Bloomberg) -- A pair of Federal Reserve officials who vote on policy this year backed moderating the pace of interest-rate increases as two others voiced support for additional hikes.

Dallas Fed President Lorie Logan and Philadelphia Fed chief Patrick Harker laid out the case on Wednesday for another downshift in the central bank’s tightening campaign when officials next meet.

Their comments followed data showing US retail sales fell in December by the most in a year while producer prices declined, extending a months-long pullback in inflation.

“A slower pace is just a way to ensure we make the best possible decisions,” Logan told an event at the University of Texas at Austin’s McCombs School of Business. “We can and, if necessary, should adjust our overall policy strategy to keep financial conditions restrictive even as the pace slows.”

Harker, reiterating comments he made last week, said increases of 25 basis points would be appropriate going forward.

“I think we get north of 5 - again we can argue whether it’s 5.25% or 5.5% - but we sit there for a while,” he told an event hosted by the University of Delaware.

Both officials vote this year on the Federal Open Market Committee, which investors widely expect will raise rates by a quarter percentage point when it meets Jan. 31-Feb. 1.

Officials hiked by a half point last month to a target range of 4.25% to 4.5%, slowing the pace of rate increases after four straight 75 basis-point moves.

Their remarks followed earlier comments from St. Louis Fed chief James Bullard and Loretta Mester of the Cleveland Fed – both closely-watched policy hawks – who stressed the need to keep tightening policy.

“We’re almost into a zone that we could call restrictive - we’re not quite there yet,” Bullard said in an online Wall Street Journal interview, explaining that price pressures remain too high and officials must not “waver” on bringing them steadily down to the Fed’s 2% target.

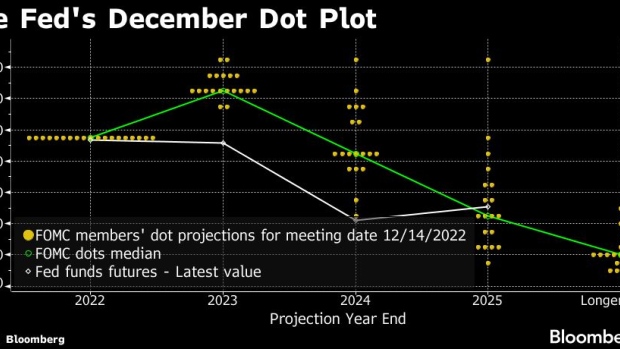

“Policy has to stay on the tighter side during 2023” as the disinflationary process unfolds, he added, saying that he penciled in a forecast for a rate range of 5.25% to 5.5% by the end of this year in the Fed’s December dot plot of projections.

The disclosure shows that he was among a group of five of the Fed’s 19 policymakers who saw rates in that range at the end of this year, with two other officials projecting rates at 5.5% to 5.75%. The median rate projection was for 5% to 5.25%.

Consumer prices rose 6.5% in the 12 months through December, marking the slowest inflation rate in more than a year, Labor Department data showed.

“We’re beginning to see the kind of actions that we need to see,” Mester said in an interview with The Associated Press published Wednesday. “Good signs that things are moving in the right direction.”

Mester didn’t disclose how big a rate increase she favored when officials next meet, but stressed that she wants rates to keep moving higher.

“We’re not at 5% yet, we’re not above 5%, which I think is going to be needed given where my projections are for the economy,” she said. “I just think we need to keep going, and we’ll discuss at the meeting how much to do”

Bullard, who has been among the most hawkish of Fed officials, repeated that he favored “front-loading” of rate hikes and would like to move to the committee’s forecast above 5% as soon as possible.

Asked if he would be open to raising rates 50 basis points at the meeting in two weeks’ time, Bullard said, “Yes, why not go to where we are supposed to go, where we think the policy rate should be for the current situation?”

Recent data are giving mixed reports on the US economy. While retail sales declined, suggesting consumers are losing some of their resilience, the labor market remains strong with unemployment dropping to 3.5% last month. And growth was tracking about 4.1%, according to the Atlanta Fed’s tracker on Jan. 10.

“The prospects for a soft landing have improved markedly,” Bullard said. “The risk to the soft landing is that the inflation data doesn’t cooperate and goes in the other direction.”

©2023 Bloomberg L.P.