Mar 29, 2022

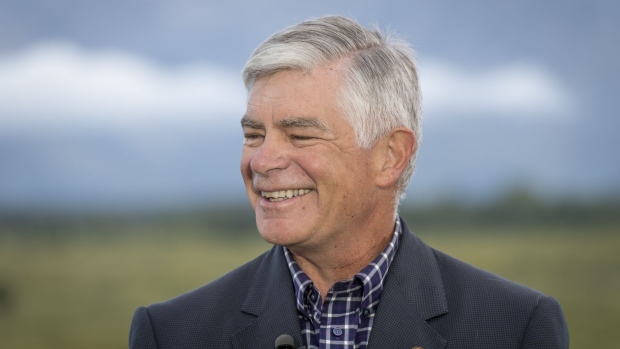

Fed’s Harker Says He Is Looking For ‘Methodical’ Hikes This Year

, Bloomberg News

(Bloomberg) -- Philadelphia Federal Reserve Bank President Patrick Harker said he expects a series of “deliberate, methodical” increases in the benchmark federal funds rate this year while reduction in the U.S. central bank’s holdings of Treasuries and mortgage-backed securities will begin soon.

“The bottom line is that generous fiscal policies, supply chain disruptions, and accommodative monetary policy have pushed inflation far higher than I -- and my colleagues on the FOMC -- are comfortable with,” Harker said Tuesday, referring to the policy-setting Federal Open Market Committee. “I’m also worried that inflation expectations could become unmoored,” he added in remarks prepared for an event hosted by the Center for Financial Stability in New York.

Harker is voting as an alternative member of the FOMC in the place of the Boston Fed, which is currently without a president. Its new leader, University of Michigan economist Susan Collins, will take up the post on July 1.

Fed officials raised their benchmark lending rate off zero this month with a quarter-point increase. Since then, several policy makers have said they are open to hiking by a more aggressive half point at their May 3-4 meeting, including Chair Jerome Powell, if necessary to bring price pressures under control.

Investors have subsequently increased their bets on the pace of policy tightening, with interest-rate futures pricing in more than eight additional quarter-point increases over the remaining six policy meetings this year, implying that some will be half-point moves.

Harker implied that he was not currently in favor of front-loading rate increases, noting that he expects “a series of deliberate, methodical hikes as the year continues and the data evolve.”

He said the economy will post another above-trend growth rate of around 3% to 3.5% this year before falling back to trend of around 2% to 2.5% in the next few years. He said inflation will rise 4% this year before falling back toward the 2% target over the next two years.

U.S. central bankers have pivoted to a more aggressive posture on raising interest rates following Russia’s invasion of Ukraine, which is putting upward pressure on food and energy costs at a time when inflation is already at a 40-year high. The Fed’s preferred price measure rose 6.1% for the 12-month period ending January, triple its 2% target.

©2022 Bloomberg L.P.