Mar 19, 2021

Fed to end COVID-19 capital break it granted Wall Street banks

, Bloomberg News

The Federal Reserve will let a significant capital break for big banks expire at month’s end, denying frenzied requests from Wall Street.

In response to the pandemic, the Fed had let lenders load up on Treasuries and deposits without setting aside capital to protect against losses. That relief will lapse March 31 as planned, the Fed said in a Friday statement.

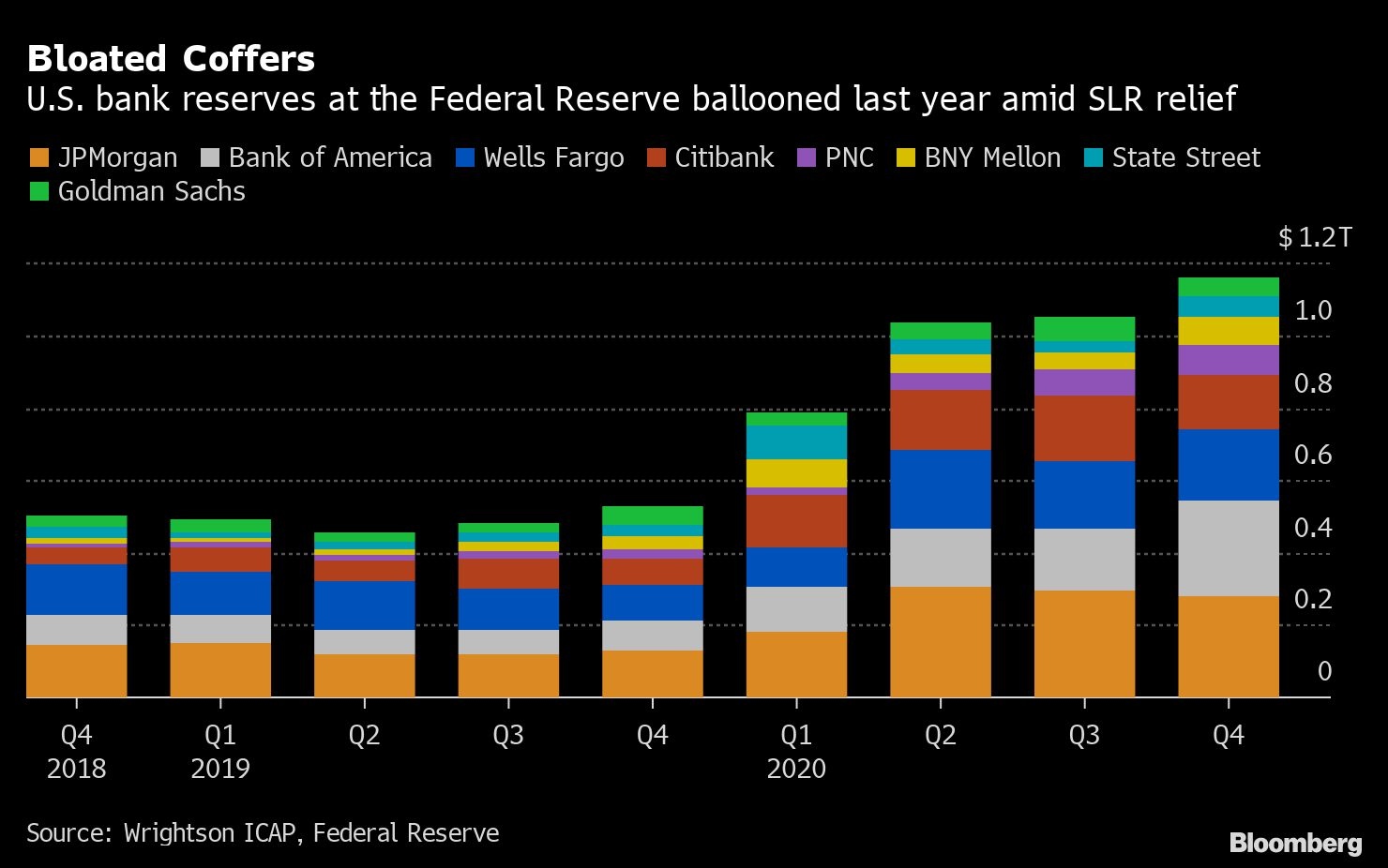

Though the regulator concluded the threat that COVID-19 poses to the economy isn’t nearly as severe as a year ago, the Fed also said it will soon propose new changes to the so-called supplementary leverage ratio, or SLR. The goal is to address the spike in bank reserves triggered by the government’s stimulus programs.

“Because of recent growth in the supply of central bank reserves and the issuance of Treasury securities, the board may need to address the current design and calibration of the SLR over time to prevent strains from developing that could both constrain economic growth and undermine financial stability,” the Fed said.

The expiration of the temporary capital break may disappoint banks and bond traders, as many industry analysts had wanted the Fed to extend the deadline for at least a few months, especially since the US$21 trillion Treasury market has seen recent volatility.

Treasury dealers already have been exiting the market at a rapid clip -- more than US$80 billion was pulled in the last two weeks in advance of the central bank’s decision. But Fed officials believe the market is sufficiently stable and banks’ capital is high enough to return to the pre-pandemic requirement while the agency considers long-term changes.

Banks’ Buffer

The biggest U.S. banks have nearly US$1 trillion in capital, meaning they are already above the US$800 billion that they need to comply with the full SLR, according to Fed estimates. Lenders themselves will have to decide how much they want to exceed the agency’s minimum requirement.

With the Fed declaring banks to be well capitalized, there’s a chance it will no longer be able to justify its pandemic-spurred constraints on dividends. While the regulator already relaxed an earlier ban on stock buybacks, it’s still restricting shareholder payouts. Fed Chairman Jerome Powell said this week that a decision is coming soon on dividends.

“This takes out of play the biggest political impediment to the Fed removing all COVID-19-related restrictions on big bank capital distributions,” Jaret Seiberg, an analyst for Cowen & Co., wrote in a Friday note. The Fed could drop its remaining constraints this year, he predicted.

Central bank officials provided no details on the permanent modifications they’ll propose to the SLR, but they did say they don’t want the industry’s overall capital levels to change. The Fed added that it will work with the other banking agencies: the Office of the Comptroller of the Currency and the Federal Deposit Insurance Corp. Those regulators also announced Friday that they will let the temporary relief end March 31.

The agencies’ decision means big banks such as JPMorgan Chase & Co., Citigroup Inc. and Bank of America Corp. must soon return to their customary SLR -- a measure of their capital against all their assets.

‘A Mistake’

“It’s a mistake,” Priya Misra, global head of rates strategy at TD Securities, said in a Bloomberg Television interview. “I don’t think the market was ready for this relief to be removed.”

The KBW Bank Index fell 1 per cent as 2:12 p.m. in New York, with all but one of the 24 companies in the index slumping. JPMorgan declined 2.7 per cent, the biggest drop on the index, followed by Wells Fargo & Co. at 2.2 per cent.

The 10-year Treasury yield rose after the announcement, as many Wall Street strategists speculate the end of the regulatory break will induce some banks to shed Treasuries. The benchmark borrowing rate hovers at about 1.75 per cent.

The Fed did provide another recent consolation, though, by more than doubling to US$80 billion the maximum overnight reverse repo activity a participant can execute through the central bank’s facility. That could absorb some of the pressure of too much government stimulus cash sloshing through the system by giving money market funds a place to put it.

As Credit Suisse Group AG’s Zoltan Pozsar put it this week, the Fed is “foaming the runway” to deal with the stress of going back to the existing leverage rule by giving banks an additional ability to direct deposits into money market funds. Fed officials said Friday that move was a monetary-policy decision and not directly related to the leverage limit.

For the past year, that relaxed leverage cap had allowed the lenders to take on as much as US$600 billion in extra reserves and Treasuries without bumping up their capital demand. The banks could now be under pressure to shed some of those assets or seek more capital.

JPMorgan has said it might consider turning away certain deposits as a result. And some Treasury market strategists expect a hit to the market as the biggest lenders potentially sell holdings.

The Fed faced intense political pressure from Democratic lawmakers, including Senate Banking Committee Chairman Sherrod Brown and Senator Elizabeth Warren, to let the capital break lapse March 31. While Democrats lauded Friday’s announcement, they will likely scrutinize the agency about its decision to propose permanent changes to the SLR. In a Feb. 26 letter to the Fed, Brown and Warren called it “one of the most important post-crisis regulatory reforms.”

Brown said in a statement Friday that ending the break is “a victory for lending in communities hit hard by the pandemic.” In a message on Twitter, Warren called it the “right decision for keeping our banking system strong.”

This was the right decision for keeping our banking system strong. Now we need to make sure the giant banks don't try to sneak in a back-door reduction in their capital requirements. This is too important.https://t.co/jD6bcRS7c7

— Elizabeth Warren (@SenWarren) March 19, 2021

Ira Jersey, a rates strategist for Bloomberg Intelligence, predicted regulators will eventually let banks exclude reserves from their SLR calculations, but not Treasuries.

The leverage ratio, adopted as a key safety measure after the 2008 financial meltdown, has always been a three-agency effort. Though the Fed and OCC had proposed a wide-ranging overhaul in 2018, that project stalled. Fed officials said Friday they’ll work with the OCC and FDIC to determine what’s next. However, the Fed has been known to sometimes move independently on capital rules.

--With assistance from Michael McKee, Alexandra Harris, Liz Capo McCormick and David Scheer.