Oct 29, 2023

Five Key Charts to Watch in Global Commodity Markets This Week

, Bloomberg News

(Bloomberg) -- Soaring sugar and cocoa prices come at a rotten time for consumers seeking a sweet treat heading into the holiday season. Meanwhile, Big Oil earnings continue with Shell Plc and BP Plc reporting. Elsewhere, spot gold has jumped above $2,000 an ounce for the first time since May amid geopolitical conflict and economic uncertainty.

Here are five notable charts to consider in commodity markets as the week gets underway.

Metals

Escalating tensions in the Middle East, a hazy economic outlook and mixed corporate earnings are driving plenty of momentum in bullion. Yet, it’s a clouded picture for the safe-haven asset. Spot gold’s swift acceleration to $2,000 was driven by traders covering short positions in the aftermath of the Hamas attack on Israel. But global holdings in bullion-backed exchange-traded funds see ongoing outflows.

Agriculture

With Halloween a few days away, it’s a good time to check in on sugar prices. Futures have been trading near a 12-year high as the market weighs an uncertain supply outlook. Shipping bottlenecks in top supplier Brazil are making it difficult for the sweetener to reach global markets, while faltering exports from India and Thailand have further weighed on prices. That — coupled with soaring cocoa futures — has raised input costs for candy and chocolate ahead of a busy holiday period when consumption tends to peak. The “big four” season for candymakers kicks off with Halloween, celebrated on Oct. 31, and is followed by Christmas, Valentine’s Day and Easter, according to the Washington-based National Confectioners Association.

Protein

Bad news is piling up for the fake-meat industry. Archer-Daniels-Midland Co. last week said it was reassessing a planned expansion of plant-based protein at an Illinois facility due to disappointing demand. The once-hot fake meat sector has faced a growing number of setbacks, with high prices and odd tastes and textures making the costly products easy to cross off shopping lists as consumers struggle with food inflation. A growing number of alternative-protein companies are shutting down, laying off staff and selling themselves. Meanwhile, venture capital funding of the sector fell almost 40% last year from the peak in 2021, according to PitchBook data, after surging in the aftermath of Beyond Meat Inc.’s 2019 initial public offering. The trend is likely to worsen this year.

Oil

Shell and BP round out Big Oil’s third-quarter earnings in the coming days. Last week, supermajor peers Exxon Mobil Corp. and Chevron Corp. posted disappointing profits amid weak performances by their oil-refining and chemical businesses, while European giants TotalEnergies SE and Eni SpA had more positive outcomes. The mixed results come amid a backdrop of a tightening global oil market, uncertain demand and ongoing supply risks associated with the Israel-Hamas war. Crude futures have been volatile in October, with both West Texas Intermediate and Brent futures on track to halt a four-month winning streak.

Power

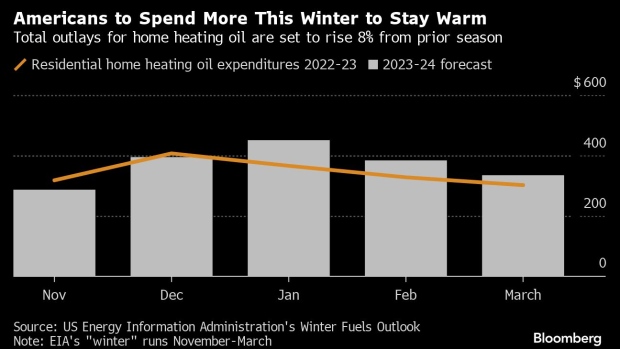

US households that keep cozy primarily with heating oil are set to spend more on staying warm this winter than last season, according to the Energy Information Administration’s base case in its Winter Fuels Outlook. While the cost of heating oil is expected to average $4.20 a gallon this winter, down from $4.31 a gallon in the prior one, it should be a colder season, which means Americans will use more heating oil, pushing expenditures up by 8% on a year-over-year basis. But there’s good news for consumers that use propane, electricity or natural gas to heat their homes: total outlays for those products on average will decline by 3%, 1% and 21%, respectively, the EIA forecast.

--With assistance from Eddie Spence and Agnieszka de Sousa.

©2023 Bloomberg L.P.