Feb 26, 2023

Foreigners Cap Longest Buying Streak in Japan Stocks Since 2019

, Bloomberg News

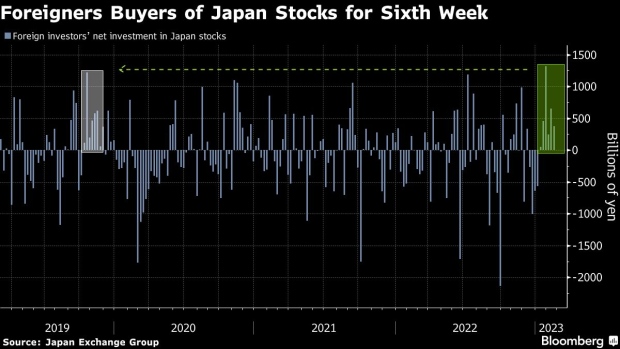

(Bloomberg) -- Foreign investors have been net buyers of Japanese stocks for six straight weeks, the longest streak since 2019, amid hopes for continued easy-money policy and expanding valuations as companies improve governance.

Overseas traders bought a net 379.4 billion yen ($2.8 billion) worth of Japanese stocks and futures in the week ended February 17, according to the latest exchange data. Buying by foreigners has helped drive the benchmark Topix up 5.2% this year, outperforming key measures of US and global stocks.

Investors have rushed to buy value stocks amid signs that an effort to improve governance is taking hold. Sentiment could remain favorable amid signs that Bank of Japan governor nominee Kazuo Ueda will continue the stimulus measures employed by current chief Haruhiko Kuroda for now.

©2023 Bloomberg L.P.