Mar 22, 2024

German Business Outlook Improves Much More Than Expected

, Bloomberg News

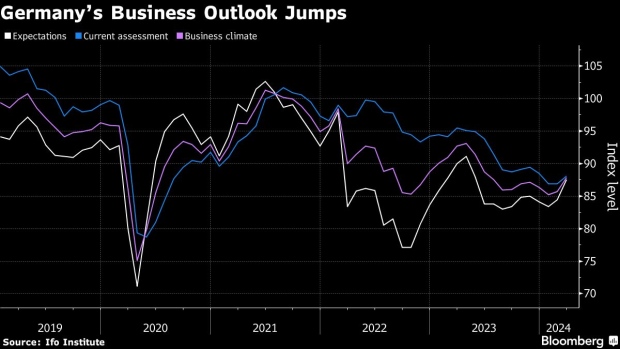

(Bloomberg) -- Germany’s business outlook improved much more than anticipated — feeding hopes that the economy will recover from a malaise that’s turned it into the euro zone’s laggard.

An expectations gauge by the Ifo institute rose to 87.5 in March from a revised 84.4 the previous month. That’s the highest since May 2023 and exceeds the 84.7 median forecast in a Bloomberg survey. A measure of current conditions also rose more than expected.

“It seems that German companies do expect to benefit from this upturn in the global economy,” Ifo President Clemens Fuest told Bloomberg Television. “We see order books still shrinking — so the improvements haven’t arrived — but at least companies are becoming a little more optimistic.”

Europe’s largest economy probably fell into a recession at the tail end of last year, with the Bundesbank reiterating Thursday that a contraction in the first quarter of 2024 is likely due to protracted manufacturing weakness.

Business surveys from S&P Global this week backed up this assessment. While the services sector saw conditions improve and approached stagnation, an index of factory activity unexpectedly declined further below the threshold signaling expansion.

Forecasters are counting on consumers to drive a modest recovery in the coming months as inflation retreats and salaries improve amid a robust labor market. Interest-rate cuts by the European Central Bank that may start in June should also ease the burden of high borrowing costs.

“We see some bright spots: we see for instance hospitality strong, we see improvements in retail,” Fuest said. “It seems that consumer confidence is indeed rising.”

The euro zone as a whole has fared better than Germany, with services gaining more momentum than anticipated in March’s Purchasing Manager Indexes.

This sort of divergence has sparked a debate in Germany over structural forces like high energy costs, adverse demographics and a strong reliance on Chinese inputs that could keep growth limited for a longer period of time.

Given the backdrop, Fuest cautioned that the improvement in Ifo’s readings are limited.

“It’s probably too early to say it’s a real turning point,” he said. “This is compatible with most forecasts that are saying it’s going to be a stagnating economy in Germany in 2024, but not a shrinking economy. So it’s a stabilization — and that’s of course welcome.”

--With assistance from Joel Rinneby, Kristian Siedenburg and Francine Lacqua.

(Updates with Fuest, starting in third paragraph)

©2024 Bloomberg L.P.