Oct 17, 2022

Germany Now Seen Dragging Euro Area Into Contraction Next Year

, Bloomberg News

(Bloomberg) -- The euro-area economy is expected to shrink next year as it battles surging energy costs and the risk of shortages following Russia’s invasion of Ukraine.

Output in the currency bloc will drop by 0.1% in 2023, according to economists polled by Bloomberg who were still predicting growth of 0.3% a month ago. Germany, the euro area’s largest economy, is seen contracting by 0.5% while France, Italy and Spain are expected to expand.

Germany’s strong reliance on Russian natural gas put it in a perilous position after war in broke out in Ukraine. With prices for energy and a growing range of goods jumping, consumers face a surging cost of living and business confidence is low.

While the European Central Bank’s most-recent baseline forecasts see the economy avoiding two consecutive quarters of contraction, Vice President Luis de Guindos said at an event in Madrid on Monday that he couldn’t rule out the possibility of a “technical recession”.

“It is possible, but in principle this situation would not mean an excessively intense recession,” Guindos said.

“The German economy will contract at least three quarters in a row until spring of 2023,” said Dennis Huchzermeier, a senior economist at the Handelsblatt Research Institute. “But it will be an atypical recession,” because demand for labor will remain high and manufacturers still have a large cushion of orders to work through, he said.

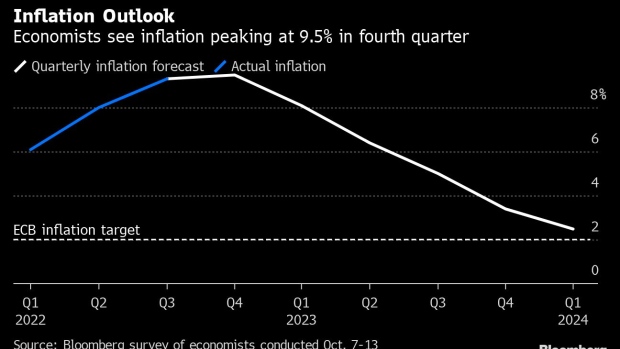

Economists revised their predictions for price growth next year higher. Euro-area inflation is now seen averaging 5.5%, compared with 5% in the previous poll. Germany saw the largest upward revision among the bloc’s major economies.

The ECB is expected to lift interest rates higher, with the deposit rate expected to reach a peak of 2.5% in the first quarter of next year. The first rate cut is expected to happen in the second quarter of 2024.

(Updates with comment by Vice President Guindos starting in fourth paragraph)

©2022 Bloomberg L.P.