Jul 5, 2022

Germany Weighs How Much Consumers Will Shoulder Uniper Rescue

, Bloomberg News

(Bloomberg) -- German officials are wrestling over how much of the cost of rescuing troubled energy giant Uniper SE they can pass onto consumers as they rush to put together a rescue package for the company squeezed by Russia’s gas war.

Ministers are set to approve legislation as soon as today that will enable government bailout packages of failing energy companies -- including taking stakes. While that’s the prime option, the bill will also create a tool to allow part of the cost of surging energy prices to be distributed among all consumers, according to a government official.

It’s not clear yet how the burden will be shared between consumers and taxpayers as officials estimate the size of the hole to be plugged at Uniper alone to about 9 billion euros ($9.3 billion).

Shares in Uniper, whose business model depends on the Russian gas flows that Moscow is now curtailing, rose as much as 11% on Tuesday after losing more than a quarter on Monday. They pared gains to stand 5.2% higher at 11:20 a.m. in Frankfurt.

Economy Minister Robert Habeck has said the crisis in the energy industry risks triggering a Lehman Brothers moment, or a domino effect in the market. Russia has already curbed its gas flows to Germany and officials are bracing for more cuts that threaten the fabric of the German economy.

The government needs to weigh up the threat that any extra levy will spur inflation and voter unrest, but it also wants to use any measures at its disposal to encourage consumers to use less gas. Habeck has signaled that higher energy prices are on way to motivate users to be more energy-efficient.

The cabinet is set to approve the legislation on the new measures on Tuesday, followed by the upper and lower houses of parliament on Friday.

Uniper declined to comment. The company said last week it was in talks with the government to secure liquidity. Analysts estimate that curbed Russian flows are costing Uniper 30 million euros a day.

Officials are moving fast ahead of the next milestone: the key Nord Stream pipeline is due to shut for maintenance on July 11, adding pressure to already fraught markets. German officials have raised the prospect that Moscow may never reopen the pipe after the maintenance, leaving the country without its main source of gas.

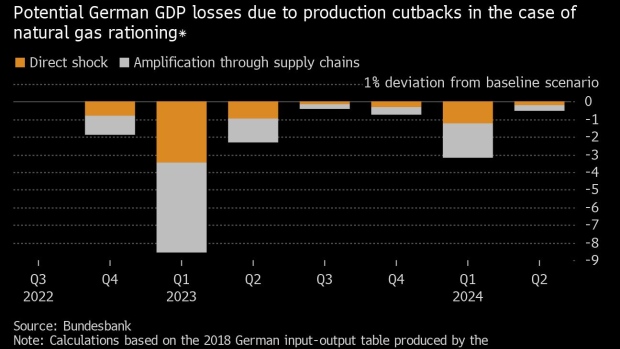

While Uniper represents the most urgent concern, the broader economy is also in peril as the government is trying to contain the fallout for consumers and industry. Plans have been drafted for rationing, with Germany’s vast industry poised to suffer shortages. Habeck has warned that worse is to come.

©2022 Bloomberg L.P.