Jan 19, 2022

Ghana Allows Overseas Bonds as Collateral to Lure Borrowers

, Bloomberg News

(Bloomberg) -- Ghana permitted the nation’s banks to accept overseas bonds as collateral in a bid to revive credit growth and spur economic activity.

Investments in offshore debt securities sold by foreign governments, companies and multilateral development banks can be used as collateral for loans, the central bank said. The securities must be denominated in dollar, pound, euro or yen and need to be rated AA or above, Bank of Ghana said in a statement on its website.

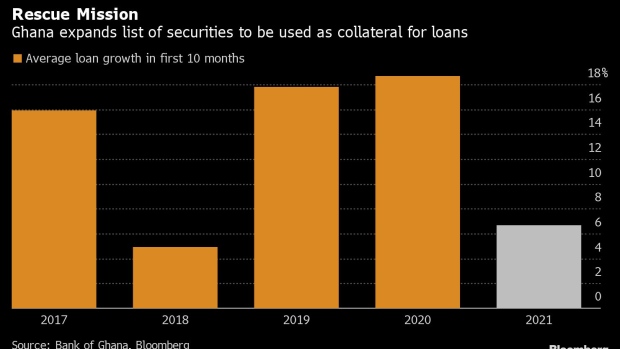

Credit in West Africa’s second-biggest economy expanded at about 6.7% in the first 10 months of 2021, the slowest pace in three years as the pandemic decimated demand. The central bank’s move may be attractive for overseas companies seeking to expand in the $68.5 billion economy, which accelerated 6.6% in the third quarter.

“Foreign companies into manufacturing, real estate and construction may be encouraged,” Benjamin Dzoboku, chief operating officer at Republic Bank Ghana Plc said by phone, adding that it may not help local firms because they won’t have such investments. It could drive loan-growth rate by an additional 100 to 200 basis points in the coming months, he said.

Lenders must desist from accepting debt securities issued by their local or international affiliates, the regulator said.

“With the foreign bonds you’re assured of your liquidity and if you use them to secure a loan in Ghana you can nourish your business well in Ghana and still have your foreign fixed-income back,” Dzoboku said.

©2022 Bloomberg L.P.