Jan 18, 2023

Global bond sales off to record start of nearly US$600B

, Bloomberg News

Conservative bonds yields are now 5-6% plus potential for price appreciation: Wealth manager

The best start to a year for bond returns is helping fuel an unprecedented debt-sale bonanza by governments and companies around the world of more than half a trillion dollars.

From European banks to Asian corporates and developing-nation sovereigns, virtually every corner of the new issue market is booming, thanks in part to a rally that's seen global bonds of all stripes surge 4.1 per cent to start the year, the best performance in data stretching back to 1999.

Borrowers looking to raise fresh financing after getting turned away for much of 2022 are suddenly encountering investors with a seemingly endless appetite for debt amid signs inflation is cooling and central banks will call a halt to the harshest monetary tightening in a generation. For many, fixed-income assets are looking increasingly attractive after last year's historic rout drove yields to the highest since 2008, especially as the prospect of a slowing global economy offers the potential for further gains.

“The run-up in bond prices has legs in our view, particularly when it comes to the investment-grade markets,” said Omar Slim, co-head of Asia ex-Japan fixed income at PineBridge Investments. “Corporate fundamentals continue to be broadly solid,” he said, adding that “the sharp U-turn we're seeing in Chinese policies will provide a much-needed boost to global growth, mitigating some of the tail risks for emerging markets and providing further support.”

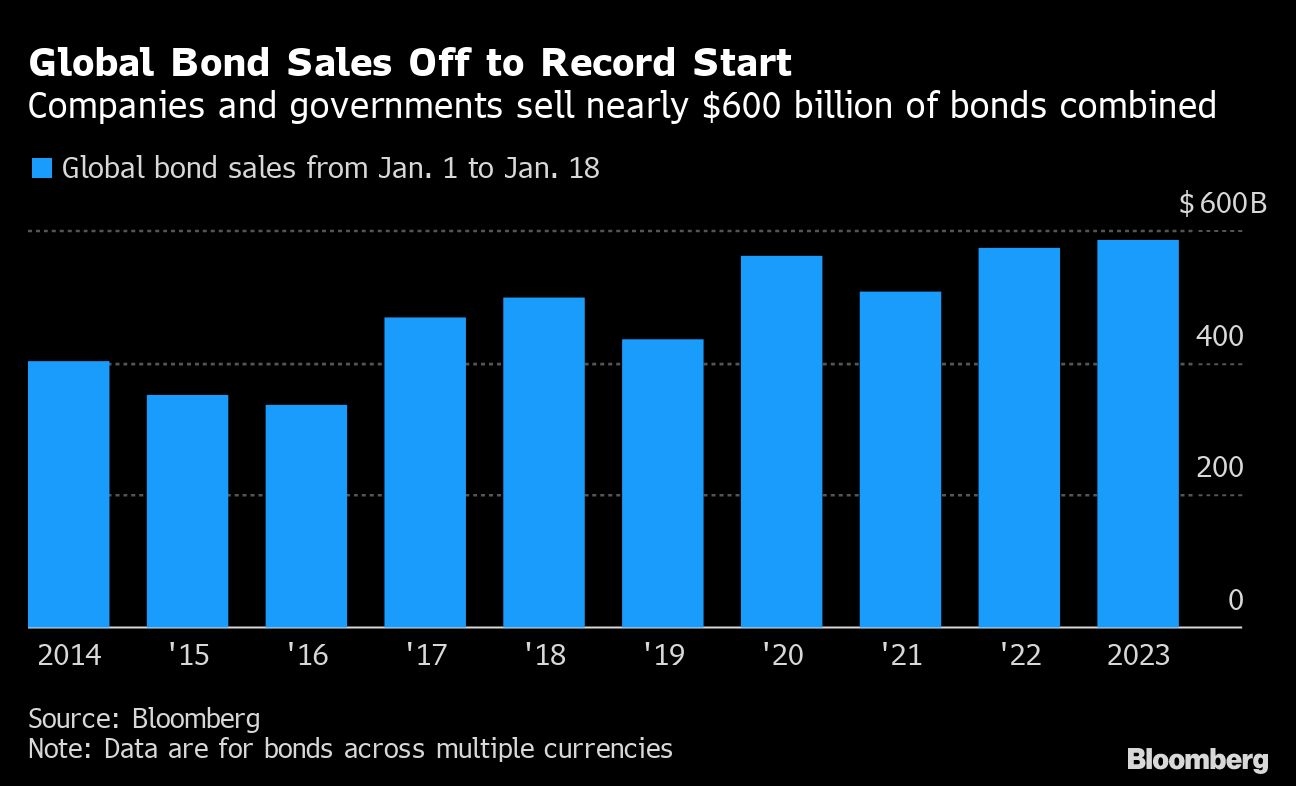

Excess demand for offerings, falling new issue concessions and the largest inflows into high-grade US credit in more than 17 months has helped make this year's January borrowing so far the busiest ever. Global issuance of investment- and speculative-grade government and corporate bonds across currencies reached US$586 billion through Jan. 18, the biggest tally on record for the period, according to data compiled by Bloomberg. More issuers were pricing deals on Thursday.

“This is a very good window,” said Giulio Baratta, BNP Paribas SA's head of investment-grade finance debt capital markets EMEA. “Investors are anticipating that inflation is calming down and seeing this as a good entry point into the market, certainly in the investment grade space and we are seeing it in the orders and how deals are tightening.”

U.S. investment-grade credit spreads hit their tightest in nine months this week, while in Europe they were the lowest since May. At 123 basis points in the U.S., they are far from highs of about 200 basis points typically seen during recessions.

Relatively high yields are a draw for investors, but some fear they won't be enough to compensate for risks as global growth sputters. A lack of supply after this month's flood could compress spreads even further, according to Collin Martin, fixed income strategist at Schwab Center for Financial Research.

“If investment grade spreads continue to decline and get back to that one per cent area, we'd start to get concerned because that would just be too tight given the economic outlook,” Martin said in an interview.

Bloomberg Intelligence forecasts U.S. investment-grade bonds will return 10 per cent this year after their worst performance in half a century in 2022. That's more than double their forecast for U.S. junk debt, as higher-quality notes often benefit more than junk when economies slow. Emerging-market and investment-grade euro-denominated credit should advance eight per cent and 4.5 per cent respectively, according to the analysts.

Here are some other notable themes seen so far in 2023:

Euro Binge

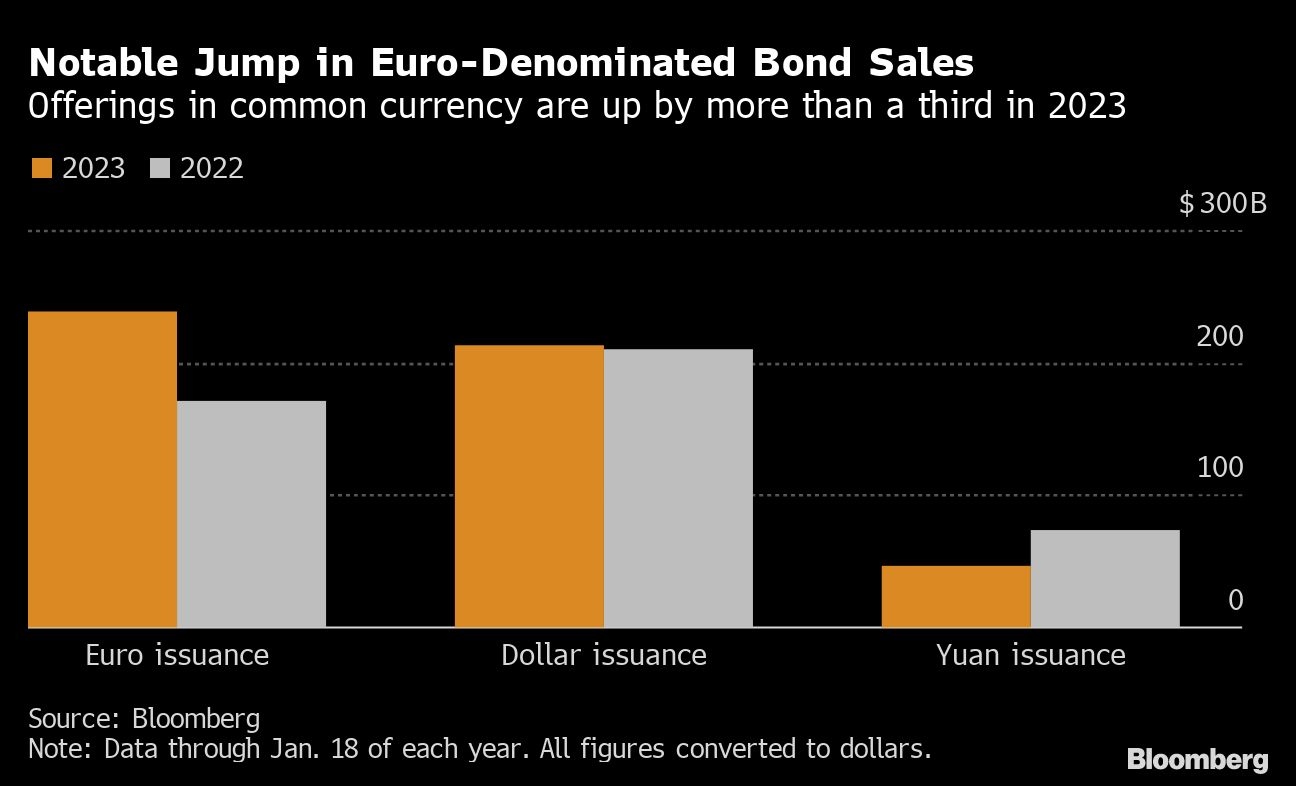

The surge in global bond sales to start the year has been uneven. Debt issuance in euros is smashing records, climbing about 39 per cent compared to a year earlier, according to data compiled by Bloomberg. Dollar bond sales are running roughly in line with last year's robust pace, the data show.

Sterling debt has also seen a bumper start to the year as euro-to-sterling hedging costs are at their lowest since March, meaning it currently costs less for a European issuer to sell sterling debt and swap it back into euros than to issue euro debt outright, data compiled by Bloomberg show.

However, there are also already signs that issuance is set to slow in some regions. Chinese onshore issuers are set to be off for a full week beginning Jan. 23 for Lunar New Year holidays, likely reducing supply in Asia to a crawl, market observers say.

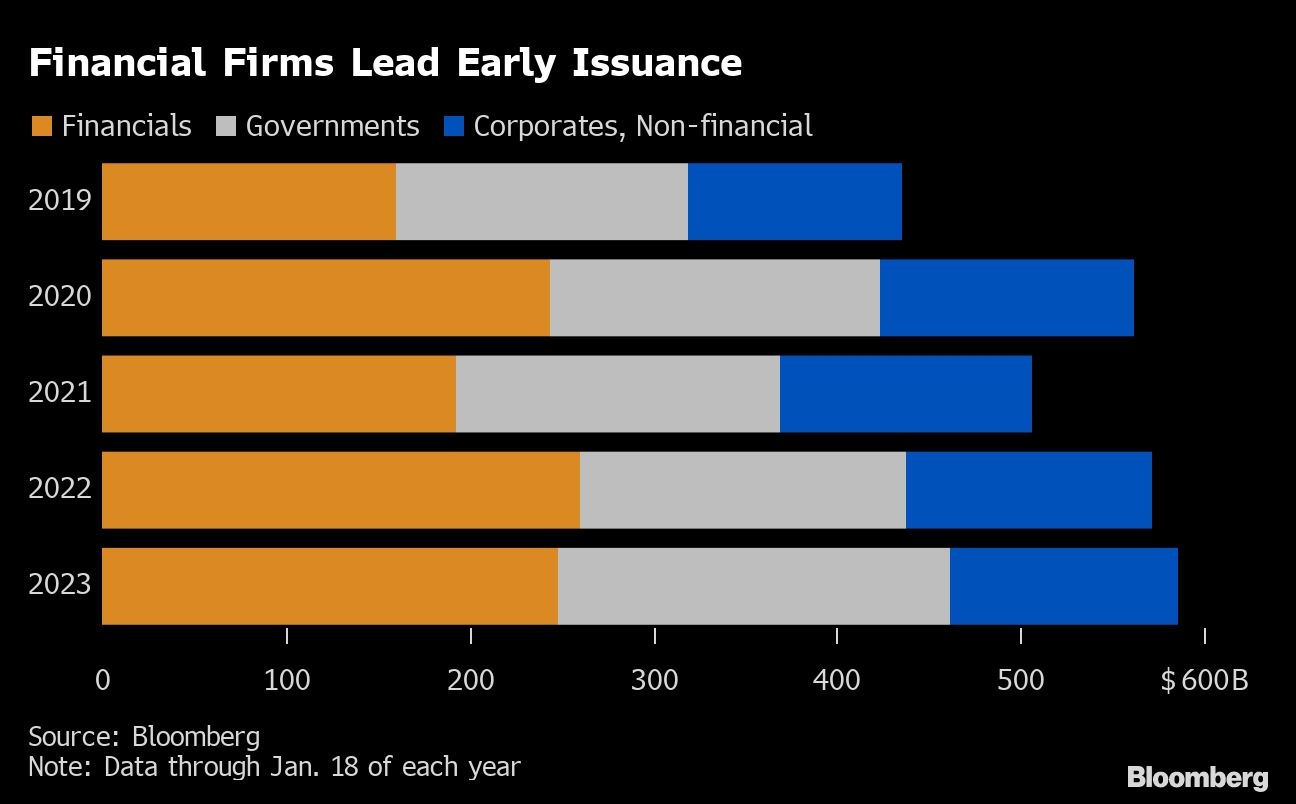

Financial firms have led the charge in global issuance this year as a sector, with year-to-date sales topping US$250 billion.

In Europe, sales from banks are already at the highest on record for any single month with over €100 billion (US$108 billion) of new bonds, according to data compiled by Bloomberg. Financial institutions are seizing on the improved risk appetite and falling credit costs to kick-start their yearly borrowing plans as well as looking to repay cheap pandemic-era European Central Bank loans.

Junk's Slow Start

One of the few markets struggling to find its footing in terms of issuance is that for speculative-grade debt. Offerings from high-yield corporate and government issuers are running at the slowest pace since 2019, with about US$24 billion priced through Jan. 18. That's likely in part because junk-rated firms that had extended maturities in years past are waiting for interest rates to decline further before taking the plunge. Investor cautiousness about how those borrowers may weather a global recession is also a likely factor.

Still, there are signs that demand may soon pick up.

High-yield deals are starting to emerge in Europe, with Tereos SCA pricing a deal this week and Telecom Italia SpA also mandating for a deal on Thursday. Orthopedic-device maker Limacorporate SpA is marketing a €295 million bond said to yield in the low 10 per cent area, while its private equity owners EQT are throwing in an equity contribution of €48.1 million to further sweeten its appeal.

Front-End Favored

Sales of notes with a three-year tenor or less have climbed more than 80 per cent to US$138.5 billion from the same period just two years ago, after yields surged in 2022. By contrast, issuance of bonds with maturities of 10 years or more has slipped.

“We are still quite defensively positioned given that we are yet to see the full impact of the rate hikes on the real economy and earnings,” said Pauline Chrystal, a portfolio manager at Kapstream Capital in Sydney. “However, the discussion for us has shifted from protecting the portfolio last year to a more balanced approach where we are also looking at how to participate in the market rally.”

Elsewhere in credit markets:

Americas

- JPMorgan Chase & Co. has set aside at least US$10 billion to back its foray into the lucrative world of direct lending, according to people with knowledge of the matter.

- UBS Group AG is recommending investors to buy European credit over US debt amid signs of distress in the US loan markets, cracks emerging in private credit and a potentially severe downside risk in US high-yield debt

- Norwegian Cruise Line Holdings Ltd. is kicking off a US$500 million junk bond sale, making it the latest borrower to capitalize on a broad rally in the high-yield market

- A subsidiary of Exela Technologies on Jan. 17 skipped interest payments on senior secured first lien notes due 2023 and 2026, according to filing

- Mitsubishi UFJ Financial Group Inc. has hired Jimmy Wilson, a director in securitized product sales, from Barclays Plc, according to a representative for MUFG

EMEA

- Issuance in Europe's primary market slowed on Thursday, though French utility EDF sought a bumper multi-currency bond deal that is set to be the region's biggest corporate transaction so far this year.

- EDF's four-part deal aims to raise the equivalent of just over €3 billion (US$3.2 billion) across euro and sterling tranches, and has attracted investor orders of over €7 billion

- More “defensive names” in the European real estate sector may look to tap the primary market for new senior unsecured bonds, “possibly sooner rather than later,” according to a CreditSights note

Asia

- The cost to insure Asia ex-Japan's investment-grade dollar bonds against default is headed for the first increase in more than a week, after renewed concerns about global economic growth emerged.

- China's US$740 billion offshore bond market awaits a fresh test of how creditors are protected by an ambiguous form of payment support, so-called keepwell deeds, as a

- key court decision looms for one of the country's biggest defaulters

- South Korea's credit market is recovering from a crisis at two speeds, with investors lapping up the debt of top-tier companies while some other firms are finding it challenging to raise funds

- Investors in India are turning away from short-term debt funds as the recent interest-rate hikes impinge on returns, and are piling into equities