Mar 13, 2024

Global Funds Cautious on Adding Japan Bank Stocks Before BOJ

, Bloomberg News

(Bloomberg) -- Global investors including Nomura Asset Management Co. and JPMorgan Asset Management are cautious about adding more Japanese bank stocks to their portfolios, even as their profitability is expected to improve on a widely-expected rate hike by the nation’s central bank as early as next week.

Nomura Asset has been taking some profit on its Japanese bank holdings. While it’s still overweighting the sector, portfolio manager Yoshihiro Miyazaki says too many people are now chasing lenders on expectation of higher rates. JPMorgan Asset portfolio manager Michiko Sakai has reduced holdings of banks, as expectations for the BOJ’s move away from sub-zero rates have already been priced in by the market.

“We’d like to own banks, but there are better options out there,” Sakai said. Within financials, insurers look more attractive on improving corporate governance, while lenders like Mitsubishi UFJ Financial Group Inc., Japan’s biggest bank, have become less attractive on a risk-reward perspective, she said.

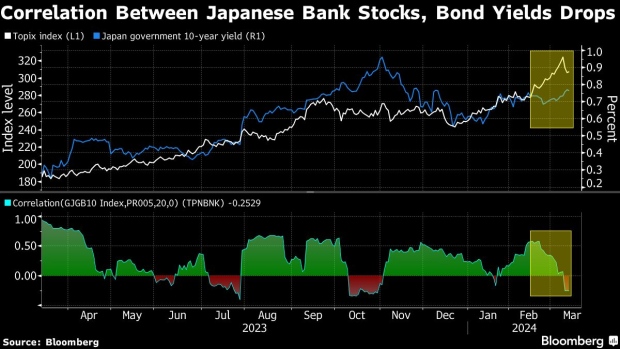

A gauge of banks on the Topix has surged almost 70% since bond yields moved higher following the BOJ’s surprise move in December 2022 to tweak its yield-curve-control policy. Speculation a further shift by the BOJ will boost profitability for lenders, whose interest income has been crushed by decades of ultra-low rates, spurred demand for the stocks. The broader Topix has risen about 40% over the period.

But the correlation between bank shares and yields has weakened in recent weeks, suggesting rising yields are becoming less of a driver. The Topix’s banks index has dropped more than 5% since Friday along with the broader market, even as speculation over a BOJ rate hike build in the lead-up to its policy meeting next week.

The Nikkei 225 Stock Average has fallen after recently reaching an all-time high, as inflation and company wage hikes add to the case for the BOJ to raise rates. Without support from bank shares, the overall stock market may become vulnerable to a rising rates environment.

Schroder Investment Management head of Japanese equities Kazuhiro Toyoda, whose fund is overweighting financials, says he doesn’t plan to add more. It will likely take time for the BOJ to assess whether it can continue to raise rates after exiting its negative-rate policy, though market expectations could still drive bank shares further, he said.

--With assistance from Eddy Duan.

©2024 Bloomberg L.P.