Mar 20, 2023

Gold Rises Above $2,000 for First Time in a Year on Haven Demand

, Bloomberg News

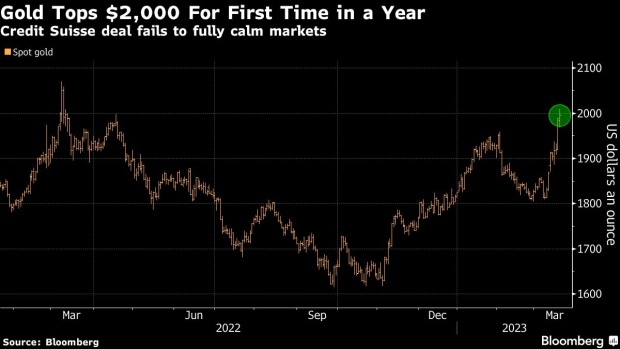

(Bloomberg) -- Gold slipped after earlier rising above $2,000 an ounce for the first time in a year as a deal to buy Credit Suisse Group AG failed to fully ease fears over the global banking sector.

The haven earlier rose as much as 1% despite regulators worldwide rushing to shore up market confidence over the weekend. The ongoing banking woes are also spurring bets that central banks may embark on a slower pace of monetary tightening.

Read More: UBS to Buy Credit Suisse in $3 Billion Deal to Fight Crisis

Bullion surged 6.5% last week in its biggest advance since early on in the pandemic after several regional American lenders collapsed and concerns grew over the Swiss bank’s health.

“The treatment of AT1 bonds has introduced a new source of uncertainty,” Marcus Garvey, head of metals strategy at Macquarie Group Ltd., wrote in a note. “The longer uncertainty rolls on, with neither market fears being wholly calmed nor a full-blown systematic crisis unfolding, the higher gold prices should be able to trade.”

It’s a sharp turnaround for bullion, which slid last month on expectations the Federal Reserve would continue its aggressive monetary tightening to curb inflation. Those bets have since been greatly diminished, with swaps traders now split on whether the central bank will hike again this year.

That’s a boon for non-yielding gold, and investors have responded by increasing their allocations to the market. In tonnage terms, exchange-traded fund holdings of the metal rose the most since April last week, according to an initial tally by Bloomberg.

All eyes will now shift to the Fed’s two-day meeting that culminates Wednesday, “where the outcome is going to be the most difficult to predict in years,” said Ole Hansen, head of commodities strategy at Saxo Bank A/S. A shift to a more dovish outlook from policymakers at a time when inflation remains hot could push gold even higher.

Spot gold fell 0.5% to $1,978.64 an ounce as of 12:20 p.m. in New York, after earlier climbing as high as $2,009.73. The last time bullion traded above the $2,000 mark was in March 2022. The Bloomberg Dollar Spot Index was 0.4% lower. Silver and palladium dropped, while platinum gained.

Copper traded on the London Metal Exchange advanced as risk appetite improved moderately. Most other base metals were higher.

--With assistance from Swansy Afonso, Martin Ritchie and Jason Scott.

©2023 Bloomberg L.P.