Jan 20, 2022

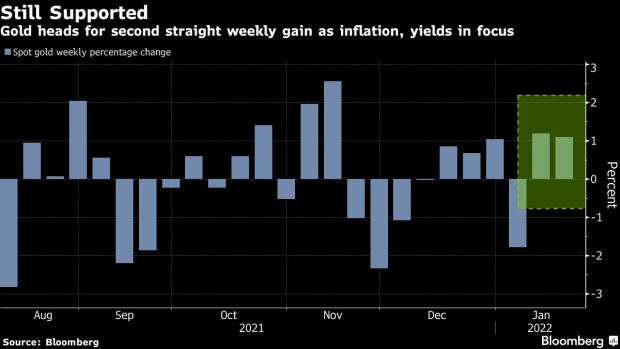

Gold Set for Second Weekly Advance as Inflation, Yields in Focus

, Bloomberg News

(Bloomberg) -- Gold headed for a second straight weekly gain as investors sought an inflation hedge amid a retreat in U.S. bond yields and equities.

With the U.S. consumer price index rising the most in almost 40 years in the 12 months through December, there’s been added pressure on the Federal Reserve to tighten monetary policy.

Still, U.S. Treasury Secretary Janet Yellen said Thursday she continues to forecast inflation falling close to 2% by the end of 2022. The yield on 10-year Treasuries has slipped from a two-year high, while the S&P 500 fell 1.1% Thursday.

Bullion is holding near a two-month high even as central banks prepare to dial back stimulus and inflation-adjusted bond yields rise. Fed officials are walking a tightrope as they lay the groundwork for a series of interest-rate increases that could begin as soon as March. The policy-setting Federal Open Market Committee meets on Jan. 25-26.

Recent volatility in markets and geopolitical tensions has also supported demand for haven assets. A report that Washington is allowing some Baltic states to send U.S.-made weapons to Ukraine stoked concerns about a standoff with Russia.

Spot gold was steady at $1,838.83 an ounce by 8:10 a.m. in Singapore, and is up 1.1% this week. The Bloomberg Dollar Spot Index edged lower after climbing 0.2% in the previous session. Silver, platinum and palladium all retreated.

©2022 Bloomberg L.P.