Dec 14, 2022

Goldman Sachs Says EM Asia Currency Rally Can Continue Into 2023

, Bloomberg News

(Bloomberg) -- Asian currencies are set to cap one of their biggest two-month rallies on record, and Goldman Sachs Group Inc. predicts that more gains are in store for the region’s low yielders.

The Bloomberg JPMorgan Asia Dollar Index has climbed 5% since end-October, with the Thai baht, South Korean won and Malaysian ringgit spearheading the advance. There have only been two other occasions — both in 1998 — when the gauge posted a larger increase over a two-month period.

Regional currencies have staged a sharp rebound in recent weeks as the Federal Reserve looks to slow its pace of tightening and China dismantles Covid curbs. But some strategists warn that risks lie on the horizon: the US may continue to hike aggressively and the Chinese economy faces headwinds from a surge in virus cases.

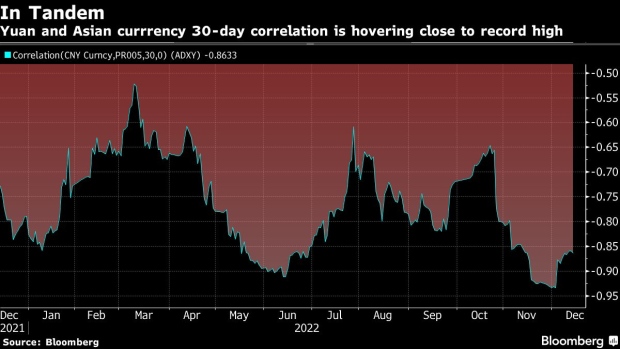

But for now, China’s move to roll back Covid restrictions is giving the currencies a much-needed fillip. The 30-day correlation between the onshore yuan and the Asian FX index is hovering at 0.86, near the record high of 0.93 reached in early December.

“China’s reopening process – which started sooner than many had expected – is likely to drive significant, currency-positive impacts on regional economies,” Goldman strategists including Danny Suwanapruti wrote in a note Tuesday. “The outperformance of Asia ex-Japan’s low-yielders appears justified given China’s reopening” as they have historically been key beneficiaries of a pick-up in Chinese growth, they added.

The US bank is more circumspect on the outlook for emerging markets more broadly. It notes that the easing of China’s curbs and Fed optimism only help to explain some, but not all, of the currency rally since the FOMC’s November decision.

©2022 Bloomberg L.P.