Oct 3, 2022

Goldman Sachs Sees ‘Historic Value’ in Singapore Rate Premiums

, Bloomberg News

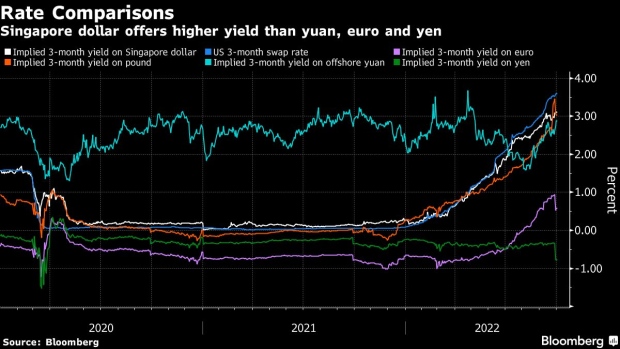

(Bloomberg) -- Goldman Sachs Group Inc. said tighter liquidity has created “historic value” in Singapore interest rates.

Interest rates on the Singapore dollar have risen above those on the currency basket that the Monetary Authority of Singapore is estimated to manage its currency against for the first time in decades, Goldman strategists Jonathan Sequeira, Rina Jio and Andrew Tilton, wrote in a research note dated Oct. 1.

The “highly unusual” positive rate differentials price in an annual depreciation of about 0.5% in the Singapore dollar over two years, which is in stark contrast to the 1.5% pace of appreciation that the MAS is estimated to be seeking now, the strategists wrote.

“To us, the positive rates differential signals historic value in Singapore rates versus global rates,” they said. “This adds to an already long list of reasons to prefer Singapore fixed-income assets over global bonds.”

Unlike other central banks, the MAS uses exchange rates to keep inflation in check. As such, expectations of a faster pace of currency appreciation typically lead to lower interest rates than those in the city state’s major trading parters as currency gains and limited returns on debt balance out.

The MAS is scheduled to release its biannual policy decision in October. Singapore’s core inflation quickened to the fastest pace since 2008 in August, with the MAS and trade ministry saying it’s projected to stay elevated over the next few months.

Premiums on the city state’s interest rates have “to do with a significant tightening in domestic liquidity conditions due to the impact of the rising dollar on FX hedging demand from local banks, investors and non-financial corporates,” the Goldman strategists wrote.

“A significant weakening in the dollar would set the stage for significant Singapore yield outperformance versus global yields in coming years,” they said. “We are watching the dollar closely, and will proactively look for opportunities to go long Singapore rates versus global rates when there are signs that dollar strength may be peaking.”

©2022 Bloomberg L.P.