Jul 1, 2022

GPIF, World’s Top Pension, Has Annual Gain Despite Quarter Loss

, Bloomberg News

(Bloomberg) -- The world’s biggest pension fund posted a gain for a second consecutive fiscal year as overseas stocks advanced and strength in the dollar versus the yen helped boost the value of its assets abroad.

Japan’s Government Pension Investment Fund returned 5.4%, or 10.1 trillion yen ($74 billion), in the year ended March 31, with assets totaling 196.6 trillion yen, it said Friday in Tokyo. Overseas stocks were the best performing investment, handing it a gain of 18.5%, followed by foreign bonds, which returned 2.3%. Domestic equities added 2.1%, while local bonds lost 1%.

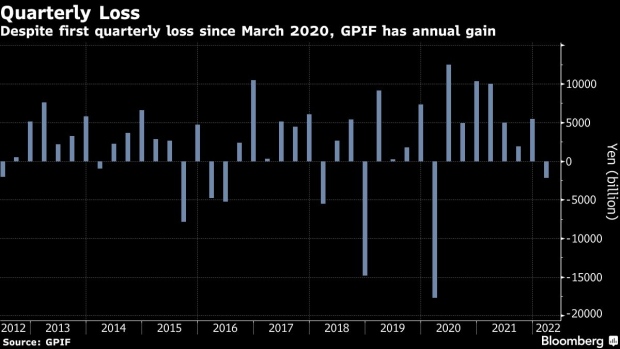

In what was otherwise a strong fiscal year, the fund had a loss during the January-March quarter, the first under the watch of GPIF President Masataka Miyazono since he took the top post in April 2020 in the wake of a pandemic-induced global equity rout. Total assets shrank for the first time in two years, dropping from a record high of 199.3 trillion yen at the end of December.

“We had a 5.42% gain for the fiscal 2021 due to sharp rises in foreign equities and a weakening yen,” Miyazono said in a statement. “Although German shares dropped due to the war in Ukraine and a resurgence of the coronavirus pandemic, strong performances in the US stock market helped overall foreign equities.”

During the fiscal year, the MSCI All-Country World Index of global stocks gained 5.7% and the S&P 500 Index climbed 14%, while the Topix index slipped 0.4%. Yields on 10-year U.S. Treasuries rose 60 basis points in the period, while benchmark Japanese government bonds yields added 9 basis points. Japan’s currency weakened 9% against the dollar.

The GPIF’s holdings of Japanese debt, which once made up more than a third of its assets, had the worst annual performance since the year ended March 2006 as bets on rate hikes in the US put Japan’s so-called super-long bonds under pressure. Japan’s public pension funds collectively scooped up a net 160 billion yen of overseas securities in the January-March period, while buying three times the amount of Japanese government bonds, according to central bank data.

For the three months ended March, the fund had a 1.1% quarterly loss. Japanese stocks lost 1.2% during the period. Foreign stocks lost 0.6%, while domestic and foreign debt lost 1.5% and 1.2%, respectively. The GPIF wrote off its Russia-related holdings as information on the assets was hard to obtain, it said.

The GPIF has a general target to keep its basic portfolio evenly allocated into four asset classes consisting of stocks and bonds, foreign and domestic. Alternative assets accounted for 1.07% of GPIF holdings, below the allowable limit of 5%. The fund holds the majority of its stock investments in strategies that track indexes.

©2022 Bloomberg L.P.