Jul 13, 2022

Hard Times for Stock Pickers as Quants Roar Back, Bernstein Says

, Bloomberg News

(Bloomberg) -- Stock picking is getting more difficult, according to Sanford C. Bernstein strategists.

Rising macroeconomic risks and volatility have caused historically low correlation in the performance of equities to climb back to average levels, according to strategists led by Sarah McCarthy. That’s bad news for active funds, threatening to halt an improved performance in the first half of this year.

“High stock correlations mean stocks are being less driven by idiosyncratic or stock-specific factors and therefore makes it harder for active managers to pick winners and losers,” they wrote in a note. “We think it may be harder for stock pickers to outperform going forward as conditions are not as easy as those which prevailed last year.”

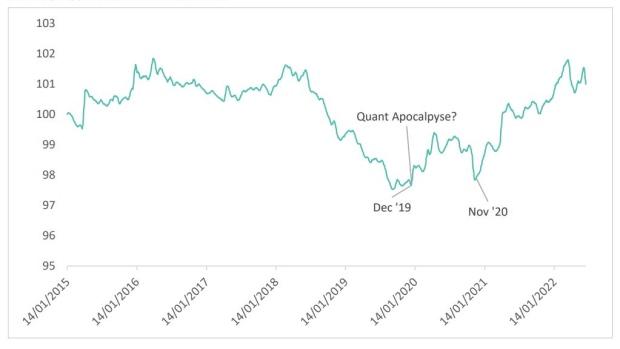

The climate has turned more in favor of quant funds, which are staging a comeback after several years of underperformance, the strategists said.

Risk-adjusted returns have shown “a marked improvement” since mid-2020, while metrics such as valuation, growth, quality, capital use and momentum are working more in favor of quants than they were in 2019 and 2020, the strategists wrote.

©2022 Bloomberg L.P.