Mar 1, 2023

Hedge Funds Balk at Major ESG Intervention Planned in Europe

, Bloomberg News

(Bloomberg) -- One of the world’s biggest hedge-fund associations said Europe may be overstepping its legal authority with a planned intervention in the market for ESG investing.

The European Securities and Markets Authority wants funds marketing themselves as ESG or sustainable to start meeting minimum portfolio thresholds to justify such labels. The proposal entails mandatory exclusions that lawyers say have the potential to upend the fund industry.

Adam Jacobs-Dean, global head of markets at the Alternative Investment Management Association, said such a fundamental change should go through the European parliament, in addition to a planned review of ESG disclosures by the EU’s executive branch.

ESMA lacks the necessary “solid legal basis” to proceed, according to AIMA, whose members oversee $2.5 trillion. “Such a prescriptive set of potential changes” as those planned by the watchdog need to be “properly scrutinized,” Jacobs-Dean said in an interview.

ESMA has said it’s still considering feedback and expects to issue final guidelines in the coming quarters. The watchdog didn’t respond to a request for comment for this story.

ESMA’s proposal was intended as a response to criticism of the EU’s rulebook for investments touting environmental, social and governance goals. Known as the Sustainable Finance Disclosure Regulation, the two-year-old framework has been slammed by industry insiders, national regulators, retail investor groups and academics for its perceived shortcomings.

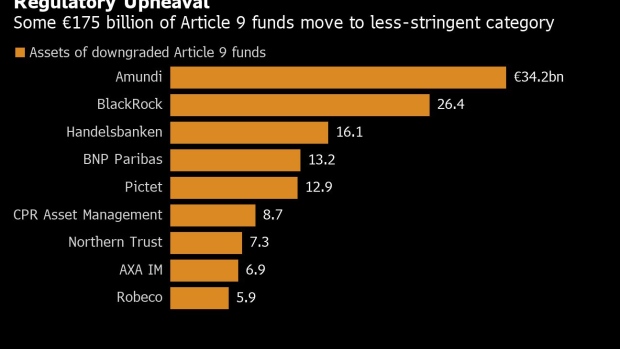

The urgent need to fix SFDR became painfully clear last year, after asset managers operating in the EU resorted to mass fund reclassifications in response to shifting interpretations of the rulebook. Funds holding about $190 billion in client assets lost the EU’s top ESG designation — known as Article 9 — in the fourth quarter alone. And given the EU’s requirement that such funds now hold 100% sustainable investments, there’s more to come, according to analysts at Morningstar Inc.

The investment industry is now worried that a similar fate awaits the EU’s much bigger ESG fund category, known as Article 8. The designation, which Morningstar says covers about $4.6 trillion in client assets, is firmly in the crosshairs of ESMA’s planned labeling requirements. The watchdog said that funds calling themselves ESG need to have at least 80% of what they do fit that label. Funds also calling themselves sustainable need to prove that no less than half of the 80% lives up to the claim.

According to the Securities and Markets Stakeholders Group, which advises ESMA, 80% of Article 8 funds currently calling themselves sustainable may need to change their names because of the proposal. Alternatively, they’d need to change the fund strategy.

Meanwhile, the EU has yet to provide much needed guidelines on what it means by a “sustainable investment.”

“The manner and timing of this particular intervention by ESMA is not helpful,” said Sonali Siriwardena, partner and global head of ESG at Simmons & Simmons in London. “It is not ideal to suggest a minimum threshold on sustainable investments when the industry is still awaiting further guidance on the definition of what constitutes a sustainable investment.”

Other members of the asset management industry have also criticized the ESMA proposal, including the Global Impact Investing Network.

Lawyers at Linklaters LLP have looked at the ESMA proposal and say it oversteps the legal parameters within which the regulator is supposed to operate.

ESMA is empowered to interpret legislation such as SFDR, said Julia Vergauwen, an attorney at Linklaters who advises fund managers. But setting investment thresholds represents a “substantive” change that goes “far beyond” its interpretative powers, she said.

Vergauwen said the proposed limits on labeling may add confusion. That’s because ESMA says thresholds would need to be met by funds with terms related to ESG and sustainability in their names, but hasn’t produced a list of those words.

“It could be everything, pretty much,” Vergauwen said. “So water, is this a neutral term or is this an ESG term? Can you use the term water in your fund’s name without falling under this scope of ESMA consultation?”

AIMA is also contesting ESMA’s legal authority to impose exclusion criteria. Raza Naeem, a partner at Linklaters, has referred to the exclusion proposal as the “most problematic” corner of ESMA’s plan. He also said that “funds with multi-asset strategies, or those which use derivatives” are most likely to be in the firing line.

Given the potential fallout, Jacobs-Dean said he hopes Europe won’t allow the ESMA proposal to pass in its current form.

SFDR “already exists and there’s no getting around that,” he said. The regulation “was developed through the normal legislative process, and to change it you have to equally follow that process.”

--With assistance from Greg Ritchie.

(Adds reference to other criticisms ESMA has faced.)

©2023 Bloomberg L.P.