Mar 14, 2022

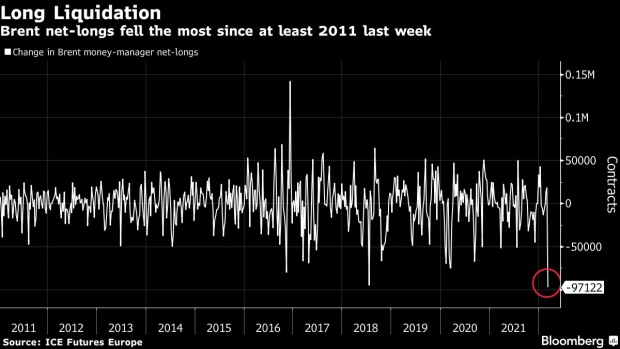

Hedge Funds Made Record Cut to Bullish Oil Bets in Run to $140

, Bloomberg News

(Bloomberg) -- Money managers made the biggest cut to their net-bullish Brent oil bets on record last week.

The retreat shows that wild swings across the oil market were part of a broad-based liquidation of positions, with West Texas Intermediate, diesel and gasoline futures all seeing speculators closing out long contracts.

The pullback in Brent was driven by the biggest reduction in outright bullish bets since 2018, according to Intercontinental Exchange Inc.. A day earlier, the global crude benchmark briefly neared $140 a barrel for the first time since 2008, but it since has retreated to near $108.

Crude prices have been volatile since war broke out in Ukraine. Last week, Brent traded in its biggest weekly range since futures launched in the late 1980s as the prospect of supply disruption from Russia was weighed against ongoing talks to attempt to put a stop to its invasion.

“Long liquidation across all three fuel products added to the story of speculators reducing exposure,” said Ole Hansen, head of commodity strategy at Saxo Bank.

While the decline in bullish positioning was sizable, there also was the most significant addition of outright bearish oil bets since 2016 -- about 34,000 contracts. It’s also the first time there’s been a major uplift in wagers against the market since Saudi Arabia’s energy minister said he wanted speculators who bet against oil prices to be “ouching like hell.”

©2022 Bloomberg L.P.