Mar 21, 2023

Here Are Key Takeaways From IMF’s $3 Billion Sri Lanka Bailout

, Bloomberg News

(Bloomberg) -- Sri Lanka clinched a $3 billion bailout loan from the International Monetary Fund after six months of negotiations. Now comes the harder part: getting a debt restructuring agreement and seeing through monetary policy and tax reforms.

The Washington-based lender’s executive board approved the program on Monday, a shot in the arm for a nation that’s struggled with food shortages, soaring inflation and eroded reserves. This makes it the 17th bailout from the IMF since the 1960s for the South Asian country that’s only completed nine of them.

There are reviews every six months for the four-year loan program. Funds will be disbursed based on Sri Lanka’s ability to meet these targets that include wealth taxes and government commitments as well as reining in inflation and building up reserves.

Here are the big takeaways:

Debt Restructuring

Sri Lanka has committed to presenting a debt restructuring plan to creditors by end-April, giving it a little more than a month to work with legal and financial advisers. Key to this is whether local currency debt will be included in the process.

Fitch Ratings has said the debt talks may drag as not all creditors agree on including local-currency sovereign borrowing. The rating company cut its score on rupee debt in December, saying a default was probable.

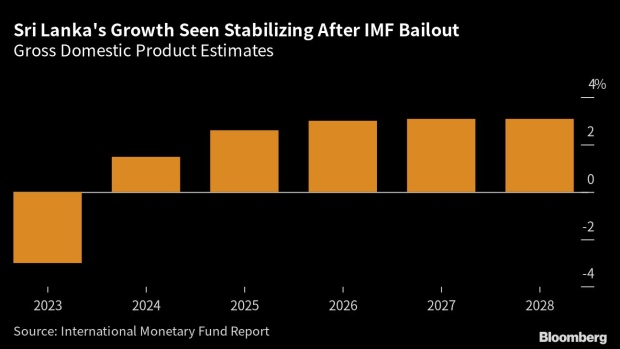

Some creditors see the IMF’s projections for Sri Lanka’s economic growth of around 3% as pessimistic. They are betting on stronger economic expansion by considering a proposal to swap defaulted bonds with new securities that would have cash flow linked to future growth.

Senior IMF Mission Chief Peter Breuer said restructuring terms have to meet the targets the lender laid out to restore debt sustainability. The country’s debt load should fall to below 95% of GDP by 2032 while a $17 billion cut in its debt servicing costs from 2023 to 2027 is also needed.

Deficits and Wealth Taxes

Sri Lanka has run fiscal deficits for decades, driven by debt and monetary financing of government expenditure. This worsened during the pandemic and exceeded 10% of GDP for 2020 and 2021 due to earlier corporate and income tax cuts as well as increased spending to shore up the economy amid a decline in tourism dollars and remittances.

The IMF program now commits Sri Lanka to improve its primary budget balance to surpluses of 0.8% of GDP next year and 2.3% from 2025 onwards from an estimated deficit of 0.7% this year. Ahead of the bailout, the government raised value-added taxes, fuel excise as well as corporate and income taxes.

To keep the momentum, the authorities will revamp the VAT system and introducing a wealth and inheritance tax before 2025. Preparatory work for these tax reforms will start in mid-2023. The IMF is expecting these measures to bring the tax-to-GDP ratio to at least 14% by 2025 from 7.3% in 2021 — one of the lowest in the world.

Monetary Policy

As the government raced to address the bills piling up amid the economic crisis, the central bank’s financing triggered an inflation surge, with the latest consumer-price growth reading over 50% for the highest, by far, in Asia. Now, the IMF is pushing a range of reforms that would put the central bank more on par with global standards.

The IMF expects Sri Lanka to approve a central banking law in parliament next month, which will help boost its independence. To ensure autonomy, there will be no government representation or participation on either the governing or monetary policy boards.

This will in turn allow for more flexible inflation targeting and greater exchange-rate flexibility. The IMF program’s objective is to see headline inflation falling back to the target band of 4% to 6% by early 2025 and it wants the central bank to stand ready to adjust its policy stance over the coming rate-setting meetings.

More so, the central bank won’t be allowed to provide monetary financing with primary-market purchases of treasury securities.

FX Reserves

There’s also the priority for Sri Lanka to develop a more liquid foreign exchange market alongside more adequate systems to manage exchange risk. While the country turned to a more flexible exchange rate, it still has a long way to get on more stable footing in this area and to convince others it’s done so.

The IMF judges that the country’s external position is “weaker than the level implied by medium-term fundamentals and desirable policies.” Sri Lanka under the program will have to unwind measures instituted during the economic meltdown that include foreign exchange and import restrictions.

The central bank will also need to build up reserves that stood at $2.2 billion in February. The IMF said this includes making outright foreign exchange purchases at a net basis of $1.4 billion this year, which will be supported by new financing, non-interest current account surpluses and other inflows.

IMF said the central bank will have to limit foreign exchange interventions to truly disorderly market conditions, and to transparently disclose moves to guide market expectations.

State Reform

Former president Gotabaya Rajapaksa proposed sweeping tax cuts before he won the November 2019 elections, and 30 months later, Sri Lanka was reeling from a decline in government revenues amid a meltdown caused by the pandemic and other policy missteps.

Rajapaksa’s hold on government as president, a role he was forced to relinquish after mass protests last year, has raised questions on Sri Lanka’s policymaking. The IMF will be reviewing the loans based on the progress on the country’s anti-corruption and governance reforms and giving recommendations, which will be published in September.

Several civil society organizations on Monday sent a letter to the IMF detailing their worries over the impact of austerity moves on the population, as well as calling for greater transparency in how the funds will be disbursed.

--With assistance from Asantha Sirimanne.

©2023 Bloomberg L.P.